All Special Report articles – Page 72

-

Special Report

Industry Comments: In your experience…

We asked leading industry figures: what can pension fund boards do better? How much time should boards spend on pension fund matters outside meetings and how much should they be paid?

-

Special Report

Tracking Railpen’s switch

Liam Kennedy asks Paul Trickett about the progress the Railpen Investments board is making in changing the way it invests

-

Special Report

Special ReportTop 400 Asset Managers 2015: Global assets top €50trn

Once again, IPE surveyed over 400 managers for this year’s study, canvassing end-2014 data in most cases. The results give a broad overview of the global asset management sector, with granular depth on European managers and institutional business

-

Special Report

Top 400: New perspective on equity strategies

Investors are waking up to the advantages of using equity strategies in portfolio construction to capture illiquidity, skill and style premia, according to Stuart Gray

-

Special Report

Top 400: Multi-asset – in search of opportunities

A complex and changing pensions market means responsiveness is key for asset managers, say Nigel Birch and Will Mayne

-

Special Report

Top 400: Disruptive change - an end to the innovator’s dilemma?

The combination of technology and innovation like exchange-traded funds looks set to change some aspects of the asset management value chain, according to Amin Rajan and Subhas Sen

-

Special Report

Top 400: A better deal on fees

Fee structures are imperfect and may be poor value. Nick Sykes outlines ways they could be improved for institutional investors and investment managers

-

Special Report

Top 400: Managing talent in a new world

Tim Wright says agility and innovation will be crucial to attracting and retaining key personnel in the asset management industry

-

Special Report

Top 400: The fee music’s still playing – for now

The institutionalisation of European asset management and changing investor fundamentals could limit the future profitability of the asset management industry, says Alastair Sewell

-

Special Report

Top 400: Time for compulsory stewardship

Asset owners and investment managers should be made to disclose their portfolio turnover and how they vote their proxies, according to Raj Thamotheram and Matthew Taylor

-

Special Report

Top 400: Investing for the future

Changing institutional investor thinking has profound implications for asset managers. Here, eight leading figures from six international organisations outline progress made on an initiative to realign institutional investment with long-term goals

-

Special Report

Top 400: Mass market – a brave new world

Andy Masters and Richard Clarke argue that asset managers need to be more focused on the end consumer and develop a range of products suitable for multi-phased retirement

-

Special Report

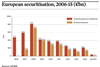

Special ReportRegulatory environment still weighted against Europe's ABS market

The European market for asset-backed securities has ample potential but suffers as a result of an unfavourable regulatory regime

-

Special Report

Euro-zone recovery: SME Lending – Affairs of credit

Everyone wants to secure funding for small businesses, which has led to initiatives across Europe designed to take up lending slack where banks have pulled back

-

Special Report

The unique case of Greece

The tribulations of recent years have turned Greece into a unique case within the euro-zone

-

Special Report

Special ReportEuro-zone recovery: Catching a tailwind

Euro-zone assets have generally performed well in recent years, but there are some substantial hurdles if their growth is to be sustained

-

Special Report

Risk parity: The interest rate challenge

Risk parity managers say they are ready to meet the challenge of acute interest rate uncertainty

-

Special Report

Two cheers for the euro-zone

January’s announcement by the ECB of its bond purchase programme has been followed by good numbers

-

Special Report

Risk parity and commodity investing

Joseph Mariathasan assesses the role of risk parity strategies in commodities

-

Special Report

Risk parity cost: The price of protection

How much should a risk parity strategy cost?