Asset Allocation – Page 26

-

News

NewsPrivate equity still too expensive – GSAM survey

Real estate is the least popular alternative asset class, with three in 10 investors looking to decrease their exposure

-

News

NewsSwiss pension funds increase equity, cut real estate investments

Schemes will likely continue to anchor Swiss and foreign real estate to investment strategies

-

News

NewsDutch pension funds move hundreds of billions in assets to mandates

Investing via mandates makes it easier for pension funds to implement their sustainability policies

-

News

NewsAPK Pensionskasse holds equity strategy, while eyeing private debt

APK plans to further develop its sustainable investment approach in the fourth quarter of this year

-

News

NewsFinland’s Keva to pile on extra €6.4bn of equities, mostly listed

Municipal pensions heavyweight gets started on implementation of board’s plan to boost returns

-

News

NewsKeva to boost equities as board ramps up risk to target higher returns

Finland’s biggest pension fund argues long-term deficit risk is the institution’s key risk

-

News

NewsGerman institutional investors plan higher exposure to alternative credit

Versorgungswerke aim for an alternative investment quota of over 50%

-

News

NewsSuperior investment returns for largest Dutch pension funds – research

However, large funds’ higher investment returns are undone fully by their lower interest rate hedges

-

News

NewsTPT launches fiduciary management and consultancy company

‘This marks the beginning of a new and exciting chapter for TPT,’ says CEO

-

News

NewsSwiss pension funds topped up rates despite losses, assets fall – study

Complementa also says one in five pension funds plan to increase their bond allocation

-

Analysis

AnalysisAnalysis: Encouraging DB schemes to take more investment risk

With the call for evidence closing today, consultants shared what needs to be done to encourage DB schemes to take on more investment risk

-

News

NewsPRI calls for work on tools to integrate net zero in strategic asset allocation

PRI report delves into recommendations to meet investors’ climate data needs

-

-

Features

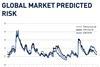

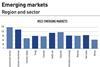

FeaturesQontigo Riskwatch - September 2023

*Data as of 31 July 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator: September 2023

US officials are talking up the Ukrainian advance towards Melitopol, a sign that all is not well. Contrary to expectations, the biggest problem is not the Russian air force, but land mines. Trump’s legal problems are as worrisome as his inexplicable lead among Republicans. US abstinence in the struggle against climate change is a potential cause for a major trade war as the EU realises it must expand its regulations on importing ‘dirty’ products to prevent a free rider problem undermining its climate efforts. In the UK, Labour’s lead over the Conservatives remains crushing, making it difficult to claim the government has a popular mandate.

-

Special Report

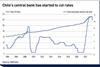

Special ReportInvestors take a cautious asset allocation path on Asia

Investing in the region is far from straightforward, with benchmarking particularly tricky

-

Features

FeaturesThe US dollar’s declining status as a global reserve currency

The recent US debt ceiling negotiations have brought into question the viability of the US dollar’s status as a global reserve currency. Long-term investors have been reviewing their strategic asset allocation away from the currency, seeking to diversify their exposure and to take advantage of long-term investment opportunities.

-

Features

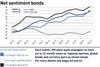

FeaturesFixed income, rates & currency: Uncertainty persists

As the major central banks in developed markets reach, or at least near, the end of their hiking cycles, markets, rather than identifying when policy rates will peak, focus is now on the conundrum of just how long these policy peaks will be maintained.

-

News

NewsAllianz Austrian pension funds turn to impact investment funds

In real estate and infrastructure the Vorsorgekasse excludes investments in fossil fuel companies