Asset Allocation – Page 24

-

News

NewsInarcassa to up private markets allocation with private debt investments

The scheme has conducted a new round of investments in 13 new vehicles for total commitments of over €240m

-

News

NewsInvestors remain committed to alternatives, survey finds

AI is also becoming a bigger focus both for allocation and for LP’s own processes

-

News

NewsGlobal public funds favour India over China, says OMFIF

80% invest in China due to benchmark index inclusion

-

News

NewsInstitutional investors see geopolitical bad actors as 2024 economic threat

Institutional investors have ‘good reason for concern’ as the geopolitical landscape is looking ‘less stable going into 2024’, says Natixis research

-

News

NewsRailpen framework to help investors assess their capacity to invest in illiquids

The framework focuses on the illiquidity aspect of private markets, rather than the potential for additional return or diversification

-

News

NewsNorway’s SWF sets out plan to become $40-70bn private equity investor

Tangen says now is very good time to start building private equity portfolio, with discounts available in secondary market

-

News

NewsPension fund appetite for private markets dips, says bfinance

Demand for new managers remains strong for niche areas related to sustainability, according to the consultant

-

News

NewsDanish pension funds’ unlisted allocations reach 23%

IPD CEO defends alternatives from critics: ‘Unlisted investments are important parts of the economic cogwheels in our society.’

-

Features

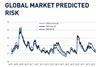

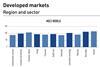

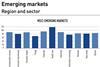

FeaturesQontigo Riskwatch – December 2023

*Data as of 31 October 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

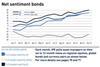

FeaturesIPE Quest Expectations Indicator - December 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

FeaturesThe great desyncronisation age in global financial markets

Investors are witnesses to the end of an era of synchronised global growth, when China could be counted on for outsized expansion that provided a broad cross-border lift for economies, industries and asset classes.

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

Features

FeaturesQontigo Riskwatch – November 2023

*Data as of 29 September 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator - November 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Interviews

InterviewsReal assets at the core for Migros Pensionskasse

Christoph Ryter (pictured left) and Stephan Bereuter of Switzerland’s Migros Pensionskasse tell Luigi Serenelli about the fund’s asset allocation strategy and guiding sprit of self reliance

-

Features

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

Features

FeaturesPricing the decline of democracy for investors

History does not progress in a linear way. Science, democracy, technology, arts, the economy and any other type of evolutive process advance and recede in chaotic movements, even though they ineluctably move towards progress. Those recessions and pull-backs often go unnoticed at first, at least to the casual observer. And yet, they end up profoundly sanctioned by all stakeholders including the economy, financial markets and investors.

-

News

NewsLGPS funds invest £150m in science and innovation businesses

Funding from South Yorkshire, West Yorkshire, Greater Manchester, Merseyside and East Riding pension funds