Inarcassa, the pension fund for self-employed engineers and architects in Italy with €13.5bn in assets under management, will increase its private markets allocation through investments in private debt funds.

The scheme will also tactically invest in real estate funds focused on Italy, it announced.

Its goal for next year is to carry on with its investment programme in private markets and real estate, keeping a tactical overweight of the asset classes compared to the targets set by its strategic asset allocation, it said in its latest report on the budget outlook for 2024.

The scheme invests a total of €2.6bn in private markets – including private equity, private debt, infrastructure, venture capital and direct investments – against approximately €3.3bn commitments subscribed, and distributed across over 150 domestic and international vehicles, it added.

This year, Inarcassa has conducted a new round of investments in the real economy, both domestic and international, through the subscription of 13 new vehicles for total commitments of over €240m, it said.

Inarcassa aims to progressively realign its portfolio to its new strategic asset allocation (SAA) adopted in mid-October in order to mitigate timing risks, it added.

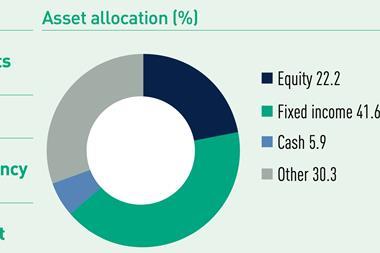

Based on the new SAA, Inarcassa will allocate 40.3% of total assets to bonds and Bank of Italy, 21% to equities, including 5% to emerging market equities, 16.2% to real assets, 19% to real estate and 3.5% in cash. The scheme targets an annual nominal return of 6.5%, and a maximum loss on a single year of 5.7%.

It has readjusted its government bond portfolio, slightly reducing global equities, in a first step to realign the portfolio to its SAA, it said.

The scheme has added this year to its equity portfolio stocks of banking group BPER Banca worth €25m, and of postal service group Poste Italiane worth €30m, it noted.

Assets under management rose from €13.2bn at the end of September to €13.5bn at the end of November, thanks to rising prices of both equities and bonds pushing gross operating returns to 5.7%, above its SAA benchmark of 5.4%, it said.

Inarcassa has put in place tactical risk hedging strategies to take advantage of any further phases of market growth and safeguard the operating result achieved so far, it said in the report.

The latest digital edition of IPE’s magazine is now available