Asset Allocation – Page 21

-

Country Report

Country ReportSolvency UK: tweaks likely to bring only marginal gains

The UK’s reforms of the Solvency II framework are unlikely to be enough to usher in a big wave of investment in domestic productive assets by insurers

-

Features

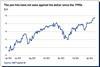

FeaturesUS economy continues to surprise

The resilience of the US economy continues to confound observers. The Federal Reserve’s 11 hikes in interest rates over the course of 2022 and 2023 were implemented to rein in economic strength and to stifle inflation. Scroll forward to the second quarter of 2024 and both inflation and economic activity are still higher than expected.

-

Opinion Pieces

Opinion PiecesDefence is the new ESG question

Earlier this year, the European Commission launched its ambitious European Defence Industrial Strategy (EDIS). The main goals of the strategy are reducing fragmentation within the €70bn European defence industry and lowering weapons imports, thus increasing the EU’s military readiness. The success of the strategy would also contribute to economic growth.

-

Opinion Pieces

Opinion PiecesUS public pension funds focus on labour practices in private equity

Private equity has become dependent on public pension funds, which represent almost one-third of all investors in the asset class. These schemes invested 13% of their assets – over $620bn (€580bn) in 2022 – up from 3.5% in 2001 and 8.3% in 2011, according to data from public pension research non-profit Equable Institute.

-

Features

FeaturesModelling shows net-zero investing can be profitable

Since the acceptance of the Paris Agreement in 2015, which bound nations to a legal commitment to reduce global temperatures, there has been a clear shift towards net-zero investing. While socially responsible investments are crucial for the mitigation of climate change, recent calls to row back on ESG funds suggest some hesitation.

-

News

NewsABP to reduce investments in emerging markets

The fund believes it no longer pays to be overweight the region given the expected returns for emerging market assets

-

News

NewsArticle 9 funds outflows continue amid ongoing regulatory uncertainty

Flows into Article 8 funds rebounded after three quarters of outflows

-

News

NewsAP4 resets long-term scenarios amid US trade worries

Swedish pensions buffer fund CEO sees political environment remaining problematic for years

-

News

NewsEnpam shifts to macro portfolio strategies in new LDI approach

Italy’s largest pension scheme is splitting its assets into two macro portfolios

-

News

NewsACCESS Pool seeks two private equity allocators

The aggregate size of annual commitments to both private equity allocators will be on average around £500m or more each year

-

News

NewsItalian schemes bolster ESG standards in private equity allocations

Research shows that 57% of Italian institutional investors directly buy private equity products in line with ESG criteria

-

News

NewsAlecta, APK back $436m Amundi-IFC impact-oriented EM bond fund

Public-private partnership aims to encourage issuance of green, social and sustainability-linked bonds in emerging markets

-

News

NewsFRR nets 9.68% in 2023 as return asset boost brings H2 benefits

Reserve fund also announces that CIO Salwa Boussoukaya-Nasr has been appointed to executive board

-

News

NewsTangen’s hopes dashed for SWF’s timely private equity debut

Norwegian government refuses to allow NBIM to add unlisted equity to GPFG’s asset mix for now, but moves to gather more information on the idea

-

News

Swiss corporate pension funds reviewing strategic allocations, says WTW

Re-emerging inflation, progressing de-globalisation, and geopolitical tensions weight on decisions to review investments

-

News

NewsSwiss plan liquidates Asia equity mandate as it cuts asset management costs

Pension fund for the Coop group reinvests liquidity in existing global passive equity mandate

-

News

NewsUK master trusts’ overseas equities post three times higher returns than domestic investments

Overseas equity investments do not align with chancellor of the exchequer’s plan to help grow the nation’s economy

-

Features

FeaturesIPE Quest Expectations Indicator - April 2024

The shadow of the US presidential elections is longer than normal because Trump is under several legal clouds. He could still get barred from participating but that seems unlikely. He does have a liquidity problem, a self-destructive streak, a mercurial character and no credible alternative waiting in the wings, though.

-

Interviews

InterviewsPension funds revisit allocations to China

European pension funds have reduced their allocations to China as the outlook for the country’s economy becomes more uncertain

-

Opinion Pieces

Opinion PiecesUS pension plans wrestle with China private market exposure

After a horrible 2023, Chinese stocks look cheap and attractive. But most US pension funds do not seem interested in investing in the Chinese stock market. On the contrary, they have reduced their holdings since 2020 and some are exiting entirely, according to Bloomberg analysis.