Asset Allocation – Page 23

-

Features

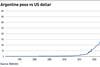

FeaturesConflict and elections set to dominate the investor landscape

Middle Eastern tensions are running high, with violence flaring up across the wider region. Combined with the ongoing attritional destruction in Ukraine, this is impacting world trade, and it seems certain that international conflict will continue to be a source of great concern in 2024.

-

Interviews

InterviewsPension funds hold on to their equities

European pension funds are looking to maintain their equity allocations, despite an uncertain outlook for global growth

-

Features

FeaturesRefining how factors impact investment returns

Investment management has undergone a significant transformation with the introduction of environmental, social and governance (ESG) investing. It emphasises a more holistic approach that goes beyond financial returns to assess long-term sustainability.

-

News

NewsGerman Versorgungswerke rethink alternative strategies

Professional pension funds invest €20bn per year and manage assets worth €270bn, investing 40% of total assets in alternatives

-

Analysis

AnalysisMansion House Compact: spotlight on Smart Pension

Smart Pension joined the Mansion House Compact in July 2023 as one of the first signatories, committing to allocating at least 5% of its default funds to unlisted equities

-

News

NewsSwiss schemes face higher national debt in medium to longer term, says Complementa

Plus: Pensionskasssen Monitor published by Swisscanto saw funding ratios of private pension funds increase from 110.1% in 2022 to 114.9% in 2023

-

News

NewsPublica makes first infrastructure investment as part of strategic shift

The fund is pursuing a four-year plan to put the new strategy in place

-

News

NewsTPR publishes private markets guidance for trustees

TPR says trustees who do not have skills or resource to explore diversified portfolios should consider changing governance model or consolidating

-

News

NewsInarcassa grows AUM to over €14bn as bonds, equities rebound

The pension fund for self-employed engineers and architects in Italy recorded a gross operating result of approximately 7.7% last year

-

News

NewsNorthern LGPS considers investment expansion in line with government consultation

Partner funds express a desite to invest in a way that is ‘financially and socially beneficial’ for local areas

-

News

NewsTelecom Italia’s pension fund rules out illiquid investments

The average age of pension members is too high to invest in those asset classes, the scheme says

-

News

NewsPKBS adjusts investment policy to navigate interest rate volatility

To fend off interest rate volatility, PKBS cut the strategic quota it held in bonds

-

News

NewsConcreto broadens investment in private markets

The scheme will invest 5% of the assets held in the sub-fund in alternatives

-

News

NewsAustrian provident funds increase allocation to bonds, equities

FMA’s report also showed that the pension schemes reduced their allocation to real estate

-

Analysis

AnalysisDutch pension funds keep increasing interest rate hedges

Funds increasingly want to protect their funding ratios in the run-up to the pension transition and see an opportunity to lock in rates at current high levels

-

News

NewsFon.Te ups private market investments to €560m

The scheme has invested 70% of the sum in the real economy in Italy through impact-investing strategies

-

News

NewsPFA expects positive 2024 returns after 2023’s bullish stance pays off

Largest Danish pension fund reports 12% customer return, praising its own ‘moderately positive’ equities tactics

-

Features

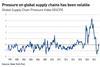

FeaturesWill delayed economic bad news hit the market this year?

Global economic growth was below potential in 2023, but still markedly stronger than the forecasts had been indicating at the start of the year, with the US leading the way and even the likes of Europe and the UK, though hardly stellar performers, posting better than expected economic activity.

-

Features

FeaturesNLP can help identify linkages between equity market peers

Natural language processing in AI provides a way to gain insights from unstructured data at scale, allowing access to information across a broad set of investment opportunities

-

News

NewsNorwegian, Swedish professors stick with advice on adding private equity to GPFG

Døskeland and Strömberg say NBIM’s preferred implementation is very similar to their advice