Asset Allocation – Page 29

-

Country Report

Country ReportItaly: Casse di Previdenza roll with the punches

Italian industry-wide pension funds fail to attract new members, with potentially serious long-term consequences

-

Opinion Pieces

Opinion PiecesViewpoint: UK defined contribution market

Many investors nearing retirement are unable or unwilling to take on the volatility associated with a more aggressive portfolio

-

News

NewsWPP launches new sustainable global active equity sub-fund

The new sub-fund has launched with £1.2bn, with all eight Welsh Funds participating, and will be managed by Russell Investments.

-

News

NewsIOSCO calls on regulatory cooperation to allow innovation

‘Globally we do not have a strong model of how to encourage innovation in a highly regulated sector like finance,’ says IOSCO

-

News

NewsEIOPA says national supervisors need more data on liquidity risks

European pension funds, insurers holding up well despite higher stability risks, says latest risk report from EU pension and insurance watchdog

-

News

NewsIlmarinen anchors new Amundi climate-focused Europe ETF with €580m

Finnish pensions major edges closer to having all its passive equities tracking MSCI’s Climate Action indices

-

Analysis

AnalysisAnalysis: German states realign €30bn pension fund assets to stricter ESG standards

Four German states have recently revised their sustainable investment strategies, sticking to stricter ESG rules

-

News

NewsCompenswiss on path to invest €1bn in private debt

The pension scheme is pursuing a more robust diversification, capturing illiquidity premium, as the bulk of its investments is still invested in fixed income

-

News

NewsDACH roundup: City of Zurich Pensionskasse bumps up alternatives

Plus: Swiss association on investments in reform process; Austrian pension funds see AUM shoot up; German Spezialfonds add green assets;

-

News

NewsDutch pension funds’ move to segregated mandates knock alternative funds

EFAMA sees gradual shift towards ETFs and index funds

-

News

NewsIlmarinen steps up ETF collaborations, anchoring €2.75bn of BlackRock launch

Finnish pensions insurer makes latest index investment as it shifts passive equities into climate-focused funds

-

News

NewsAlecta to diversify equities, cut non-Nordic exposure and add indexing

Swedish pensions heavyweight announces first steps in crisis-driven strategy overhaul

-

News

NewsPLSA conference panel pushes for ‘outcome-generating’ investments

Any long-term investment vehicle for the UK should be just as attractive to overseas investors as it is to UK investors

-

News

NewsFinnish pensions centre chief argues for 10-point rise in equity weightings

Paldanius says boosting equities allocations by a tenth could add 0.3 percentage points to Finnish workplace pension fund returns

-

News

NewsItalian pension funds lean towards domestic investments, says COVIP

Many pension funds are also expanding their investment strategies in private equity and private debt, according to the pensions regulator

-

News

NewsSwiss pension funds set to change SAA to reach bond investment targets

According to Swisscanto, 17% of pension funds surveyed adjusted their strategic asset allocation, and 35% changed allocations tactically.

-

News

NewsGerman BVV allocates €1.5bn to high rating investment grade bonds

The fund will pursue an active risk management approach, especially in volatile asset classes

-

Features

FeaturesQontigo Riskwatch – June 2023

*Data as of 28 April 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

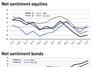

FeaturesIPE Quest Expectations Indicator: June 2023

Continued loud bickering between the Wagner Group and the Russian army is protecting Putin from both, worsening the outlook for peace, while there are multiple signs that military supplies are approaching exhaustion. The coalition supporting Ukraine is stronger than ever, showing increasing willingness to provide military aircraft. Yet the offensive expected in February has not started. In the US, Florida governor Ron DeSantis is damaging his position with an unproductive row with Disney, while Trump has moved closer to a prison term. Gas consumption in the EU is falling faster than expected, due to efficiencies like heat pumps, changeover to electricity and solar panels. Macron scored nicely by sponsoring the participation of Zelensky at the Hiroshima G7; Sunak failed to centre political attention on China.