All Asset Class Reports articles – Page 21

-

Asset Class Reports

Investing In Investment Grade Credit: Problem solving

Forthcoming solvency rules led many insurers away from equities towards corporate bonds just in time to dodge the financial crisis. With yields low and spreads tight, but the Solvency II ghost still at the feast, Joseph Mariathasan looks at what they are doing now

-

Asset Class Reports

Investing In Investment Grade Credit : Improved credit rating?

The financial crisis threw the spotlight on rating agencies. In particular, the failures in sub-prime asset-backed securities (ABS) that were seen as the catalyst that unleashed the global maelstrom of 2007-09 called into question their methodologies for rating structured products.

-

Asset Class Reports

Investing In Investment Grade Credit: Too much reliance on quick and dirty signals

Ratings agencies were given far too much authority in the era of de-regulation in order to encourage more cross-border and non-professional investment, argue Paolo Di Caro and Belmiro Oliveira. Removing their judgements from financial regulation is a belated recognition of the damage that was caused

-

Asset Class Reports

Investing In Investment Grade Credit: New year’s resolution

The end of the de-leveraging cycle could signal a comeback for senior debt issuance in 2015. But Charlotte Moore identifies the new ‘TLAC’ regulation as the truly significant factor for the long-term shape of bank capitaL

-

Asset Class Reports

Investment Grade Credit: Securing liquidity

Banks may no longer be able to make markets in non-Volcker-compliant CLOs. We look at what this means and why it could be a particular problem for European structures

-

Asset Class Reports

Investment Grade Credit: Set for new trends

Strategy Review, Investment Grade Credit: Martin Steward finds investment-grade credit portfolio managers getting excited about energy sector volatility and a big change to regulation of bank capital structures

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: New book claims that 'The Future is Small'

‘The Future is Small’ (Harriman House, 2014), a newly-published book from Miton Asset Management’s Gervais Williams, contends that while returns from large-cap stocks will remain low in an environment without decent economic growth, we are at the early stages of a multi-decade period of small-company outperformance.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Starved of capital

Central bank policies are heading for divergent paths. Joseph Mariathasan looks into the likely impact on small and mid-sized stocks, where valuations are already exhibiting marked differentiation

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Focus from diversity

Rummaging through successful small-caps portfolios reveals a diversity of opportunity, finds Martin Steward. This diversity enables portfolio managers to express very well-defined styles in their portfolio risk

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: The M&A effect

The M&A theme tends to be big in small-caps: these companies are growing, often via their own acquisitions; and becoming assets coveted by both LBO from below and large-caps from above. Our featured strategies feel its effects as both a blessing and a curse.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Keeping it in the family

Germany’s Mittelstand shows why mom-and-pop shops, despite the risks, can create superior success from local networks and a longer-term view of their businesses. Joseph Mariathasan investigates

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Taking small-caps global

Brandes Investment Partners has been managing global small caps since 1997. “It’s a big pond with a lot of fish but very few anglers,” as director of investments Luiz Sauerbronn puts it.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Northern exposure

While the Swedish stock market in general can be rather volatile, this goes to an even greater extent for Swedish small-caps. But as Caroline Liinanki finds, for those able to handle the short-term market movements investing in smaller Swedish companies has been a very profitable move

-

Asset Class Reports

Investing In Hedge Funds: About turn for top-down

Macro, the darling of the hedge fund world through the drama of 2008-09, has struggled in the subsequent low-volatility, low-rates environment. Joseph Mariathasan asks whether recent outperformance signals a more conducive backdrop for this family of strategies

-

Asset Class Reports

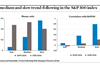

Asset Class ReportsInvesting in Hedge Funds: Is the trend your friend?

Alex Greyserman looks at how trend-following at different speeds has fared in equity markets during the post-crisis bull market and over the longer term, and finds compelling diversification benefits

-

Asset Class Reports

Investing in Hedge Funds: Uncut hedges

US pension giant CalPERS may have stopped investing in hedge funds, but despite heightened short-term scrutiny, Christopher O’Dea finds that most plans are retaining their allocations, and expecting them to deliver greater value through bespoke strategies

-

Asset Class Reports

Beleggersberaad 2014: Managers sing praises of frontier markets

Emerging market debt (EMD) has matured and could now act as a “useful addition” to a pension fund’s fixed income portfolio, according to Roy Scheepe, senior client portfolio manager at ING Investment Management.

-

Asset Class Reports

In-house strategies offer greater advantages

On The Record: Do you use external hedge funds?

-

Asset Class Reports

Interview - DMO:We want to hear from you

Robert Stheeman, CEO of the UK Debt Management Office, tells Taha Lokhandwala about the importance of ongoing dialogue with institutional investors

-

Asset Class Reports

Investing In Global Equities: Multiple problems

Does the vast amount of central bank liquidity in the system help to make sense of current equity valuations, and should investors therefore be worried about the ‘punch bowl’ being taken away? Joseph Mariathasan tries to evaluate today’s valuations