Investors should refocus on China as a new digital services economy rather than on “old China” and its production-based economy, according to AXA Investment Managers (AXA IM).

Speaking at the annual conference of IPE’s Dutch sister publication Pensioen Pro last week in Amsterdam, senior economist Aidan Yao said that the country’s transition to a services-based economy was in full swing and was driven by a fast-growing middle class, as well as innovation and new technology.

This trend was confirmed by an annual rise in research and development costs of 12% across the country during the past five years, he said.

Although the Chinese government was largely sponsoring these costs, in Yao’s opinion, the reform policy was bearing fruit “as the authorities are increasingly open to the privatisation of companies”.

Mark Tinker, head of Asian equities at AXA Framlington, added that innovative developments were boosted by China’s growing middle class population and rising incomes, as well as by the continuing migration to urban areas where more people were digitally connected.

He advised investors to shun state-owned firms “as they represent the old industry”.

The same went for indices and exchange-traded funds because they lacked sufficient technology, innovation and growth, Tinker contended.

“Only by actively investing will investors benefit from the technological revolution in China,” he said. AXA Framlington only offers actively managed funds.

Bryan Collins, head of Asian fixed income at Fidelity International, also saw opportunities in the transition to a consumption-driven services economy which was increasingly focused on the environment.

“As a consequence, new chances are created in technology such as renewable energy and air purification,” he said.

Collins also emphasised that investments were possible across the entire spectrum of the Chinese capital market, comprising a diversity of bonds in terms of duration, rating and coupon rates as well as dollar and renminbi-denominated government paper.

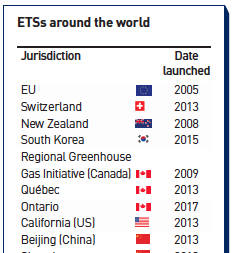

He noted that China’s “onshore bonds” for foreign investors – issued since 2015 – have been added to several indices and that this trend was accelerating.

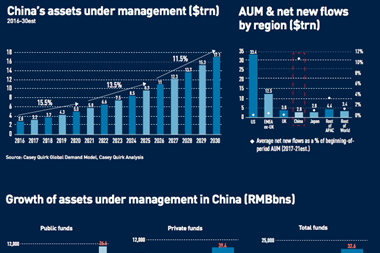

As the onshore market represents a value of $12trn (€10.1trn), the potential was enormous, according to Collins.