OCIO is a trend being encouraged by market volatility, increased portfolio intricacy, and the growing burden of regulatory compliance

The ‘Outsourced CIO’ (or ‘OCIO’) investment model first found a meaningful market presence among small- to medium-sized institutional investors with limited internal resources.

Since the onset of the COVID-19 pandemic, however, we have seen a procession of larger investors—with significant pre-existing internal investment teams—moving in this direction.

BAE Systems’ £23bn defined benefit pension scheme is one of the latest pension funds to make the shift, following in the path of other large new adopters: the Royal Mail Pension Plan, Centrica Pension Scheme and the National Grid Pension Scheme, to name a few.

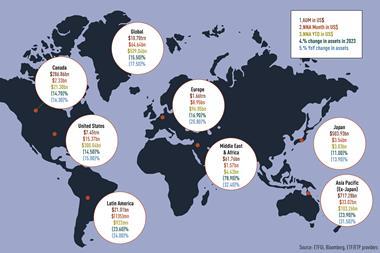

It is a trend being encouraged by market volatility, increased portfolio intricacy, and the growing burden of regulatory compliance. Recent data suggests a surge in assets under management (AUM) in this type of structure: Cerulli Associates estimates a rise from $2.4trn in 2021 to a projected $3trn by 2026.

Yet what is OCIO? How does it differ from other forms of investment outsourcing, ranging from using a multi-asset manager for a whole-of-portfolio mandate through to fiduciary management? And how can investors navigate through a universe of well over 100 potential providers of OCIO services, especially considering the conflicts of interest that can emerge when asset managers or investment consultants offer this type of holistic solution?

Understanding the model

At its core, the OCIO model refers to the delegation of investment management activities to an external party. It is a ‘whole-of-portfolio’ construct, although we do find some providers using this terminology to describe customised fund of funds solutions in areas such as alternative investments.

The services involved may encompass investment policy design, governance support, ESG policy development, risk management, manager selection, portfolio management, monitoring and reporting, among others. In theory, an OCIO provider should deliver these services to each client in a highly tailored and customised way.

Those considering the OCIO model may find it useful to weigh the differences (and blurred lines) between this approach and other highly outsourced models, such as the fiduciary manager, the multi-asset pooled fund and the multi-asset fund of funds.

There are three key areas of differentiation: the degree of control that the investor will exercise over investment policy and asset allocation, the use of third-party asset managers and the provision of portfolio-level non-investment services (i.e. operational and administrative matters).

On the first point, an OCIO typically provides an investor with greater control over investment policy and asset allocation than fiduciary management. On the second, OCIOs generally make heavier use of external asset managers than fiduciary managers. On the third, both OCIO and fiduciary managers will tend to offer a high level of support on non-investment services than a multi-asset pooled fund or a multi-asset fund of funds – though it’s worth noting that we do see some multi-asset managers offering enhanced services here, making them a potentially economical alternative to a classic OCIO construct for a smaller investor.

In its purest form, an OCIO should serve as independent, structurally unconflicted partner for their asset owner clients. In practice, however, many providers also have asset management and investment consulting businesses that can introduce potential conflicts of interest.

Independence is more clearly evident where the provider is solely dedicated to this service and outsources to third party asset managers. Yet our experiences in this sector indicate that service-level independence can be achieved irrespective of the size and complexity of the organisation.

Investors should handle the subject with care and keep an eye on direct or indirect linkages with either internal products or certain external asset managers. There may be some positive side-effects of using internal products, such as potential fee savings, but it is important to have a very clear division of services, teams, management and incentivisation.

It is also crucial to give careful thought to governance arrangements when implementing an OCIO solution. Investors turning to this model often hope to achieve a greater level of responsiveness and dynamism in response to market conditions, as well as a high standard of accountability.

Yet governance can be challenging to define when the investor and provider share responsibility for key aspects of policy and strategy, whereas fiduciary management is somewhat simpler from this perspective.

Navigating potential OCIO partners

There are now well over 100 firms capable of delivering OCIO-type provision, ranging from OCIO specialists whose revenue is almost entirely driven by this activity through to large asset managers and consultants who offer OCIO alongside their other (‘core’) services.

The top 10 OCIOs manage more than half of all OCIO assets, and each of the top OCIO’s individually manage at least $100bn worth of assets, such that AUM is heavily skewed towards the larger players.

In many cases, the firm may not be using an ‘OCIO’ label, due in part to the definitional grey areas, but the investor wishing to find the most suitable and competitive offering should consider a wide universe of potential solutions irrespective of name choice.

OCIO relationships are long-term strategic partnerships and transitioning between providers brings a host of challenges; getting the decision right first time is crucial. Investors should thoroughly probe and assess all areas, including experience, resourcing, co-ordination, technology, philosophy, future assessment, conflicts of interest, and costs.

In summary, as the investment landscape evolves, the OCIO model offers a potentially flexible and responsive solution for asset owners navigating challenging terrain. As with all strategic decisions, careful consideration and due diligence are the keystones to a successful OCIO partnership.

Toby Goodworth is a managing director, head of liquid markets and a member of bfinance’s senior management team