Falling interest rates are piling pressure on Dutch pension funds, with Mercer and Aon Hewitt estimating that average coverage ratios dropped by a full 2 percentage points to 94% over the first week of July.

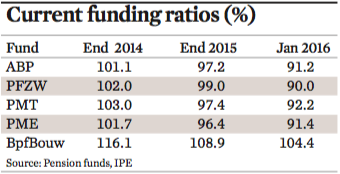

At the beginning of this year, Dutch schemes’ day-to-day funding stood at 104% on average.

Over the first week of July, the 30-year swap rate – the main criterion for discounting liabilities – fell from 0.88% to 0.70%, increasing liabilities by 3-4% on average, according to Mercer actuary Dennis van Ek.

As of the end of June, Dutch pension funds’ ‘policy funding’ – which estimates average funding over the 12 months’ previous and is the main criterion for rights cuts and indexation – stood at 100% on average, according to Mercer.

Using a slightly different methodology, Aon Hewitt placed the figure at 99%.

Mercer attributed the recent funding drop almost entirely to falling interest rates.

At the end of last week, global equity markets remained more or less at the levels seen at the end of June, when they had almost fully recovered from the initial losses following the Brexit referendum.

Meanwhile, Dutch regulator De Nederlandsche Bank (DNB) confirmed that three pension funds must begin discounting pension rights this year due to their precarious financial position.

The regulator assessed the recovery plans – where schemes spell out how they expect to raise funding to the minimum of 105% within 10 years – of more than 180 of the 300-odd pension funds in the Netherlands.

The regulator did not name the three pension funds involved but said about 9,000 workers and 500 pensioners would be affected by the rights cuts.

Jetta Klijnsma, state secretary at the Ministry for Social Affairs, previously estimated that 27 pension funds, if they failed to improve their funding position by year-end, were facing rights cuts next year.