Some 26 local government pension schemes (LGPS) have called on the UK chancellor to remove the ‘principal advice’ requirement on asset allocation.

In recent research conducted by consultancy Hymans Robertson and published this week, the LGPS funds and scheme advisory boards expressed their views on recent proposals put forward for the LGPS market by chancellor Rachel Reeves, as the LGPS consultation closed yesterday.

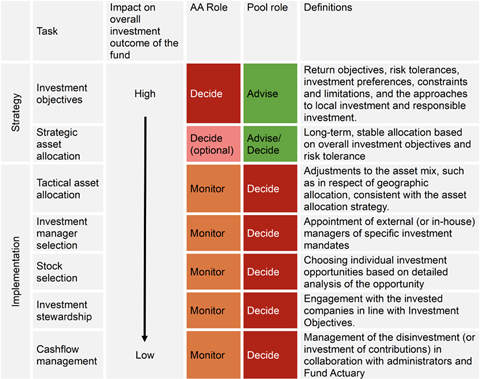

One of the proposals by the chancellor is that investment pools now replace the role provided by investment consultants and independent advisers in providing investment strategy advice to LGPS funds.

It is proposed that funds work with their pools to set high-level investment strategy objectives, such as target levels of return and risk, investment preferences and constraints and responsible investment issues.

The roles and responsibilities of the Administering Authority versus the pool

Source: Ministry of Housing, Communities & Local Government

According to Hymans Robertson, it is “difficult” to see how the pools can, currently or in the near future, meet the new requirements.

It added that forcing funds to take strategic advice from an unprocured, single entity risks inefficiency and poor outcomes, particularly as pool teams are unlikely to be able to be as well-resourced and resilient as investment consultants who are able to share the costs across far larger client footprints.

Funds taking part in the Hymans Robertson research expressed concerns that sourcing advice from an investment pool would conflict with the independence and tailoring that are so important to their financial outcomes.

Scheme advisory boards expressed concerns from a governance perspective about “perceived, if not actual, conflicts of interest which arise where the pool is the fund’s principal, and possibly only, source of investment advice”.

Funds also expressed concern that the inability to change advisers from their pool to other providers if dissatisfied with the pool’s advice or performance, would reduce the incentive for pools to offer top-quality services.

Instead of introducing principal advice, Hymans’ paper puts forward an alternative solution to obtaining investment strategy advice in the LGPS via three pillars.

Firstly, funds should continue to be able to procure their own investment strategy advice, including from the pools if funds so wish. This procurement can continue to be on a competitive basis, helping to achieve lower fees. This will allow funds to continue to appoint the best value-for-money provider and give pools time to develop their offering, whilst addressing the concerns of conflicts of interest.

Secondly, advice can be limited to the solutions of the pool, or that could be reasonably provided by the pool, including being able to invest in other pools’ solutions if a fund’s own pool doesn’t offer a solution. This manages the risk of advice being given to invest in asset classes and solutions outside of the pool.

Thirdly, new ideas for attractive investment opportunities can continue to be raised by the adviser, to be discussed with the pools, to ensure that the LGPS investment returns continue to benefit from market innovation and diversification.

Read the digital edition of IPE’s latest magazine