Cassa Geometri, Italy’s first pillar pension scheme for surveyors, plans to allocate €150m in private equity alternative investment funds (AIFs) to reach its strategic asset allocation targets.

The pension scheme has decided to invest in private equity in Italy, more widely across Europe, and globally, starting a process to select two AIFs by June.

The scheme will pursue buy-out and growth capital strategies, investing in primary or secondary markets. The share of venture capital investments cannot exceed 20% of the fund, according to the scheme.

Cassa Geometri will award the mandate to an asset manager with at least €2.5bn in total assets under management, equal to the sum of NAV increased by any subscribed capital not yet called up, the scheme said.

The Italian pension scheme is proceeding with the planned allocation to private equity due to a reduction to its direct real estate portfolio for 2025 to 2027.

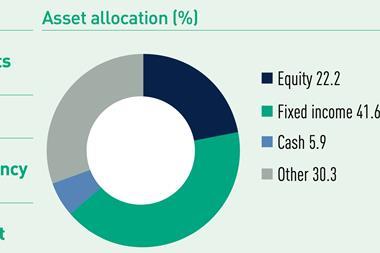

This year, the scheme plans to cut direct real estate investments to 9.1% of total invested assets, from 12.4% in 2024, and investments in real estate funds from 15.3% in 2024 to 12.2% in 2025, according to its 2025 budget forecast.

It will increase allocations to government and corporate bonds to 16% of total assets this year, from 12.6% in 2024. Assets invested will increase to €1.94bn this year, from €1.67bn last year, according to the 2025 budget.

The pension fund has a ‘war chest’ of €387.7m this year for investments in equities and bonds, it added.

It has opted for an asset/liability management (ALM) approach laying the basis for the implementation of its liability-driven investment (LDI) strategy, with assets split into a hedging portfolio to manage solvency risks, and a performance portfolio to achieve returns in the long-term. This is the same approach adopted by Italy’s doctors scheme Enpam.

The latest digital edition of IPE’s magazine is now available