Speaking at the Pensions and Lifetime Savings Association (PLSA) annual conference in Manchester this week, Fiona Frobisher, deputy director of defined benefit (DB) and pension protection division at the UK’s Department for Work and Pensions (DWP), said the PPF is “really an obvious candidate” for the role of public sector pensions consolidator.

However, she said it is still an open question as to who should the public consolidator be and then which schemes should fall into the public consolidator scheme.

She continued: “But there are two main things we are thinking about – one of which is looking at schemes that are least likely to be served by any kind of superfund market as it sets up. They tend to be schemes that are very small and therefore difficult to take on for those reasons, or schemes that have some kind of difficulties.”

The second option, she said, is building a “much bigger consolidator by taking much bigger schemes”.

David Taylor, executive director and general counsel at the PPF, also talking at the conference, agreed that the fund would be “an obvious candidate”.

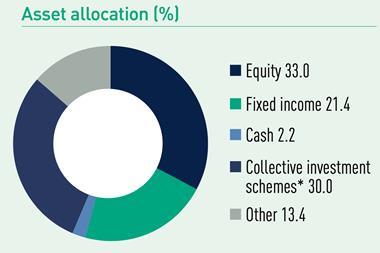

“We do think if the government [was] minded to set up a public sector condolidator, we would be well placed to take on that role. From a variety of perspectives there’s clearly an investment model that we already have, expertise and infrastructure. We already have 30% of our assets in productive finance,” he said.

Taylor added that the PPF is already consolidating schemes where an employer “has failed”, and has consolidated more than “a thousand schemes”.

DB schemes consultation

In July chancellor of the exchequer Jeremy Hunt introduced a consultation on the future of DB schemes which sought input from the pensions industry on how DB pension schemes and the PPF could support greater productive investment in the UK.

The PPF previously said it would be “well placed” to take on the role of public sector consolidator highlighting that the current framework doesn’t support DB schemes to substantially increase their allocations to productive finance assets.

It said that consolidating the schemes would allow them to invest for growth over time which would lead to greater productive finance allocations.

However, this was not entirely welcomed by the industry with Rash Bhabra, WTW’s head of GB retirement business, pointing out that it would take the lifeboat scheme 18 years to consolidate 4,500 smallest DB schemes in the UK.

The latest digital edition of IPE’s magazine is now available