French civil servant pension fund ERAFP has settled on the asset managers it wants to run its listed euro-zone, Europe and Japanese equity allocation for at least the next six years.

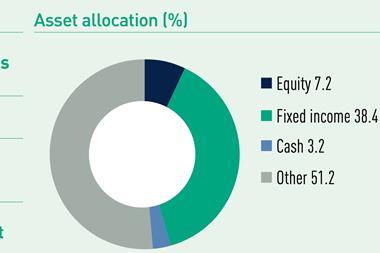

ERAFP delegates most of its asset management to external asset managers, with mandates regularly put out to tender. As at the end of December 2022, ERAFP’s equity portfolio totalled €11.5bn, with the bulk (78.4%) allocated to European equities.

The mandates it awarded were as follows:

Management of euro-zone equities using an index approach designed to replicate the MSCI EMU-based ERAFP SRI index: Amundi, with DWS on standby;

Management of euro-zone equities using an index approach designed to replicate the SciBeta Eurozone SRI CRB-efficient MSR CTB Index: BlackRock, with BNP Paribas Asset Management on standby;

Management of euro-zone mid- and large-cap listed equities, unconstrained in terms of benchmark and based on a fundamental socially responsible investment analysis of the securities in the investment universe: Allianz GI, BNP Paribas Asset Management, Lazard, Tocqueville and Edmond de Rothschld Asset Management, with Mirova and DNCA Finance on standy;

Management of European mid- and large-cap equities, not against a benchmark and based on an SRI analysis of the securities in the investment universe: Candriam, with Comgest and BlackRock on standby;

Management of European small-cap equities, unconstrained in terms of benchmark and based on a fundamental socially responsible investment analysis of the securities in the investment universe: BFT Investment Managers, delegated to Montanaro Asset Management, with FIL Gestion and Amiral Gestion on standby;

Management of Japanese equities, all caps. The allocation will not be run against a benchmark and must take SRI analysis into account: Comgest and BFT Investment Managers, delegating to Wellington Management, with Pictet Asset Management and Lazard on standby.

According to ERAFP, the overall amount allocated for each of the index management lots will be between €1-10bn, and will be between €500m-8bn for each of the fundamental management lots.

Read the digital edition of IPE’s latest magazine