IPE analysed recent high-profile cases of fines for greenwashing and asked what changes firms have made as a result, and what can be done to prevent being penalised in the first place

Green funds have undoubtedly experienced a boom in recent years, with some paying the price as a result of greenwashing accusations and subsequent fines by regulators.

In light of this, IPE looked at some recent high-profile cases and asked the affected firms what internal changes, if any, they had introduced since being fined. As well as speaking to ESG research consultants on why the asset managers received such fines in the first place, and how they can avoid being penalised in future.

In May 2022 the US regulator, Securities and Exchange Commission (SEC), introduced new rules aiming to curb greenwashing and provide greater transparency and clarity to investors. Separately, it also proposed amendments to rules aimed at preventing misleading or deceptive fund names.

What followed was authorities handing penalties to asset managers deemed to be in breach of ESG related disclosure rules and regulations.

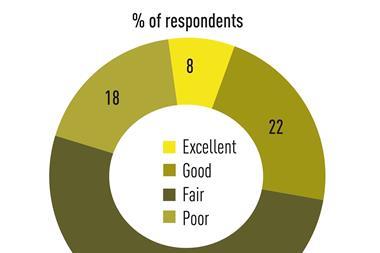

According to research consultancy Cerulli Associates, fining asset management firms that engage in greenwashing has widespread support among European institutional investors, according to its report Cerulli Edge – Global Edition.

According to the research, 85% of asset owners polled across seven markets favoured fining so-called transgressors.

“Asset owners were most concerned about misleading claims about the products’ ESG related results as well as asset managers overstating or providing unclear messaging about their level of commitment to sustainability,” said Michele Giuditta, Cerulli’s director of institutional practice.

Giuditta, who specialises in ESG investing research and leads strategic consulting engagements, added that periodic reporting and tracking of ESG funds investment objectives were among the best ways to curb greenwashing.

But how did asset managers get to a place of being fined in the first place?

By 2021 the green boom was in full flight, which saw more conventional funds piling into an area which was once seen as being the sole preserve of more niche sustainable funds. It wasn’t long before it became apparent that some funds claiming to do good, or at least ‘do no harm’, were in fact stuffed with ‘sin’ stocks and polluters. Something which governments and regulators began to take notice of and act upon.

Among some of the most high profile greenwashing fine cases include Goldman Sachs Asset Management which was fined $4m by the SEC in 2022 for “several policies and procedures failures” in the ESG research it used to select fund constituents.

In the same year BNY Mellon Investment Adviser was fined $1.5m by the SEC for “misstatements and omissions concerning ESG considerations”.

While German asset manager, DWS was fined $25m by the SEC in 2023 for “anti-money laundering violations and misstatements regarding ESG investments”.

IPE contacted all three asset managers to ask for comment on procedural changes made since being fined.

In a statement DWS told IPE that: “We have learned many lessons in an ever-evolving sustainability environment, specifically, on how to continue to improve our sustainability-related governance, processes, and controls. Thereby, one important aspect is the requirement to document and to be able to demonstrate compliance. And we have taken actions to remedy identified weaknesses.”

DWS added: “To better meet the evolving needs of our clients in particular, we continuously review and refine our approach to sustainability. This has not just been happening since the commencement of the investigations. The SEC order itself mentions certain remediation measures already implemented by DWS since at least 2020.”

The firm exemplified this with its continued action “to enhance clear approval processes for corporate communications and marketing to ensure that all of our communications and marketing are clear and appropriate”.

In addition to this, the German asset manager said it had implemented a three-pronged approach in order to tackle the issue in 2023, this included:

- establishing a dedicated sustainability strategy function to develop the group-wide ambition and strategy in sustainability;

- converting its former Group Sustainability Council into a delegated decision-making committee from the board that assumes oversight of the strategy execution;

- establishing a Sustainability Oversight Office to support the Group Sustainability Committee in their oversight role and to further strengthen its sustainability-related governance throughout the company.

Read more about DWS

Goldman Sachs shared the statement they made at the time of the fine, and told IPE it had nothing more to add on the issue.

Meanwhile, BNY Mellon said: “We take our regulatory and compliance responsibilities seriously and are committed to ensuring our communications to investors are accurate and complete.

“The prospectuses for these funds were updated at the time of the fine. BNY Mellon Investment Advisers has further enhanced its review process to meet the evolving best practice for regulatory requirements and expectations with regards to ensuring the completeness of its ESG statements.”

Financial impact of ESG controversies

Having spoken directly to asset managers fined for greenwashing, Cerulli’s Giuditta said she felt there was a recognition among some firms that they needed to provide more clarity in their messaging. She stressed, however, that as the concept of ESG labelling is so new, many who were found to be in breach had not intentionally done so. However, not all mislabelled funds fall into this category, she added.

In December 2023, the European Securities and Markets Authority (ESMA) released a report looking at the financial impact of ESG controversies.

In particular, the impact such controversies have on firms’ stock returns and valuation. The firm’s research found no systematic evidence of a relationship between the two.

“The results suggest that greenwashing allegations did not have a clear financial impact on firms and highlight the absence of an effective market-based mechanism to help prevent potential greenwashing behaviour. This underscores the importance of clear policy guidance by regulators and efforts by supervisors to ensure the credibility of sustainability-related claims,” the report noted.

Looking forward, however, a greater push towards clearer regulations has been seen in the US, Europe, and UK.

Such efforts include the International Ethics Standards Board for Accountants (IESBA) launching a consultation on two new frameworks of behaviour in companies on how to gain better trust in publicly communicated sustainability information.

This year alone, the Principles for Responsible Investment (PRI) asked the European Union to introduce sustainability reporting rules for all financial products, not just those claiming to consider environmental and social factors.

While the SEC approved major new rules on climate disclosure earlier this month, as the UK government said it would regulate providers of ESG ratings to users within the UK.

Future analysis and ‘greenhushing’ risks

Cerulli’s Giuditta said that while past research conducted by her firm focused on how funds were categorised, future research will involve a deeper analysis of the products themselves.

One question which has arisen from greater fund scrutiny is the risk of asset managers being reluctant to speak openly about the sustainability of their products, something which has been termed as ‘greenhushing’.

Greenhushing is more likely to take place in the US as a result of the chilling effect the anti-ESG movement is having on firms, according to Giuditta.

However, all is not lost here either, she said. While a third of asset managers polled told Cerulli they would be more cautious about their ESG messaging through websites, and formal documents, the same managers said they still intended to incorporate ESG considerations into their investment decisions.

“Because of this political polarisation around ESG especially in the US, firms will share their ESG focused decision with their clients, but will be less forthcoming about sharing it publicly,” she added.

Read the digital edition of IPE’s latest magazine

Topics

- BNY Mellon Investment Management

- Cerulli Associates

- Corporate governance

- DWS

- European Securities and Markets Authority (ESMA)

- Financial Conduct Authority (FCA)

- Goldman Sachs Asset Management (GSAM)

- Impact investing

- North America

- Principles for Responsible Investment (PRI)

- Securities and Exchange Commission (SEC)

- Sustainability

- United Kingdom

- Western Europe