Asset-level engagement in material sectors and categories the way forward, working group suggests

The Institutional Investor Group on Climate Change (IIGCCC) is getting closer to delivering guidance for investors on the tricky question of Scope 3 emissions in investment portfolios, with materiality set to be a focus.

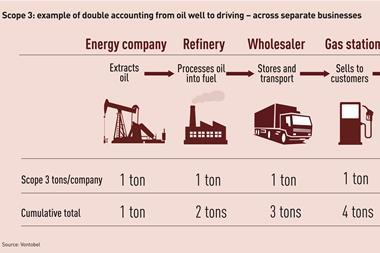

Scope 3 emissions are emissions from the value chain of a reporting entity. In an IIGCC discussion paper published today, the group said the regulatory direction of travel is towards more clarity around Scope 3 emissions disclosure, which is “increasing the urgency for companies and investors to familiarise themselves with it and prepare to calculate and disclose”.

Scope 3 emissions have been a contested subject for some time for reasons including practical challenges to do with reporting and calculation of the emissions data and challenges.

Other challenges highlighted by the IIGCC include a lack of a commonly accepted understanding of the materiality of Scope 3 categories in different sectors and (mis-)incentivisation of investee practices on climate change.

The paper published today sets out an IIGCC working group’s thinking about an investor-led solution to addressing value chain emissions within investment portfolios, in particular as part of net zero approaches.

According to the working group, while the aggregation of value chain emissions at portfolio level leads to “perverse outcomes”, investors can start to deploy asset-level engagement on these emissions in material sectors and categories.

However, it said there was a lack of comprehensive guidance on how best to approach Scope 3 materiality assessment within portfolios and that a materiality-based approach to Scope 3 was a sensible strategy for companies, but problematic.

The working group itself will explore the materiality of Scope 3 categories to different sectors as part of a second phase of work that will also look to produce guidance for investors on how they can approach Scope 3 emissions within their portfolios.

Meanwhile, according to the IIGCC, inconsistent materiality assessments is an area “in which the growing emphasis on emissions disclosures within the policy and regulatory landscape can provide much-needed clarity to the market, help to level the playing field and support investor decision-making”.

The working group also said that more widespread Scope 3 disclosure requirements at the asset level would enable investors to better meet their obligations under the Sustainable Finance Disclosures Regulation (SFDR).

The IIGCC’s thinking appears in line with that of others. David Harris, head of sustainable finance strategic initiatives & partnerships at London Stock Exchange Group, today flagged new research from the LSEG, saying that ”Scope 3 Climate reporting is one of the big debates of 2024 and we need a grown-up discussion about how to address the problems with the data”.

Key points made by the resear team, according to Harris, include that there is potentially too much discretion on how to report and that focussing on two or three categories could be the way forward.

Read the digital edition of IPE’s latest magazine