The Italian parliamentary committee in charge of the activities of social welfare institutions has given the green light to start two investigations into the investment policies of first pillar (Casse di Previdenza) and second pillar pension funds, structure of their portfolios, and their long-term results.

The committee, with 18 members of parliament (MPs) as members, will conduct the investigations in light of the challenges posed by Italy’s aging population, the green transition, the changing labour market and macroeconomic environment, and global investing, according to a committee report.

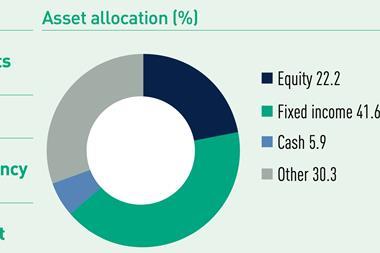

In the first analysis – which will assess investments and the composition of assets of social security institutions and pension funds – the committee will look into the structure of portfolios and their development, asset management (direct or indirect) with particular focus on the advisors’ selection processes, according to the document.

The analysis will dig into “mission-related investments”, net profitability of real estate investments, and the impact on their performance of ecological transition policies, for example the currently ongoing revision of the Energy Performance of Buildings Directive (EPBD), it added.

Moreover, the investigation will look at the impact of the funds’ investment policies on the real, national economy, the structure and effectiveness of the control and risk management systems of pension schemes, it added.

The committee wants to have an idea of the progress made by first and second pillar schemes towards the role of institutional investors contributing to the development of the country’s real economy, it said.

The investigation on pension funds’ investments will conclude on 31 December 2024.

A second investigation will look into the long-term financial sustainability of pension schemes as shown in the respective actuarial technical balance sheets, the impact of the demographic pressure, and of a changing labour market on contributions, the impact of evasions of contributions, and the effectiveness of control systems, it added.

This second investigation will conlcude on 31 December 2025.

As part of both investigations, the committee plans to hear representatives of the Ministries of Economy and Finance, Labour and Social Policies, of the Court of Auditors, of pension regulator COVIP, and the president, general director or other representatives of the Istituto Nazionale di Previdenza Sociale (INPS), the main entity of the country’s public retirement system.

It also plans to audit representatives of the Bank of Italy, the president or representatives of the association of private pension funds Adepp, and of Mefop, the organisation for the development of the pension fund market, the report added.

Alberto Bagnai, the president of the committee, said: “We will begin a series of hearings [with] supervisory authorities and bodies representing the various categories.”

Bagnai added that the committee’s agenda on these investigations is supported by “the broadest consensus” among Italy’s political parties.

Looking for IPE’s latest magazine? Read the digital edition here