PKBS, the CHF13bn (€14bn) Pensionskasse of the city of Basel, has changed its investment policy to mitigate the impact of fluctuating interest rates and achieve positive returns in the long-term, it said.

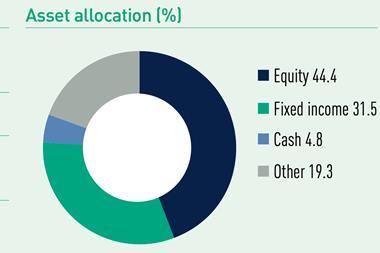

To fend off interest rate volatility, PKBS cut the strategic quota it held in bonds, allocating instead within the nominal value investments in loans, mortgages and convertible bonds, and real assets such as real estate, the scheme added explaining how its strategy has shifted over the years.

As part of its portfolio’s reallocation, the scheme’s board of directors also decided to significantly reduce the target values for liquidity and increase its private equity investment target.

Overall, PKBS moved from interest-sensitive nominal value investments to less liquid real assets.

Illiquid assets have fallen under scrutiny, with investors trying to gauge whether there is a gap between state valuations and their real value, it added. The scheme has also navigated interest rate volatility through a broader diversification, a further key element of its long-term investment strategy.

PKBS invests in nominal values and real assets, and within nominal value investments the scheme has further diversified its allocation to bonds, loans and mortgages, looking at different interest rate sensitivity, it added.

By pursuing a broadly diversified investment strategy, reducing interest rate risk in the past and widening nominal value investments, PKBS has been able to improve returns, eventually benefitting from the currently higher interest rates, the scheme said.

The fund returned 1.25% annually over the past three years, 2.35% per year over the past five years, 3.70% per year over the past 10 years.

Last year, PKBS returned 3.89%, as of November, with the first quarter of 2023 that was best performing month (2.87%), recovering from a -7.59% return recorded in 2022.

Looking for IPE’s latest magazine? Read the digital edition here