Spanish occupational pension funds will make Q1 2020 returns of between -8% and -15%, most likely eroding the “extraordinary” performance of 2019, according to estimates from Mercer.

“Initial estimates show negative returns for all types of funds, from the most aggressive to most defensive,” said Xavier Bellavista, principal at Mercer. “In some cases, the negative return will be similar to the worst figures in 2008.”

Spanish pension funds had returned an average 8.7% over the course of 2019, according to the country’s Investment and Pension Fund Association (Inverco).

This compared with a gain of 4% for the 12 months to the end of September 2019, and a loss of 3.2% for calendar 2018.

The 2019 figure brought the average annualised returns for Spanish occupational funds to just under 2.8% for the three years to the end of 2019, and just over 2.8% for the five-year period.

Separate figures from Mercer’s Pension Investment Performance Service (PIPS) showed a median return for pension funds of 7.7% for calendar 2019.

The PIPS survey covered a large sample of pension funds, most of them occupational schemes.

Funds in the survey enjoyed double-digit performance across all equity classes, including returns of 20% in euro-zone, and around 25% in non-eurozone equities.

All fixed income asset classes also achieved an extraordinary performance. Euro-zone fixed income returned between 3-4%, while non-eurozone assets returned 15%, thanks to the intrinsic asset class performance plus currency appreciation.

The best-performing alternative asset was real estate, returning 25%, while hedge funds were the poorest performing asset class, gaining only 1.5%.

In terms of asset allocation, Bellavista said most funds are maintaining long-term strategies as they are, waiting for ongoing meetings to evaluate any need for change.

“During the last quarter of 2019, some funds adjusted their tactical views for 2020 to include some defensive bias, including equity hedging strategies,” he observed.

“These funds are incurring negative returns but beating their respective benchmarks.”

“These funds are incurring negative returns but beating their respective benchmarks”

Xavier Bellavista, principal at Mercer

However, Bellavista highlighted the existence of a high dispersion of returns between funds: “This dispersion – which is also relevant in the long term, over 10 and 15 years – means that some pension funds are not achieving their minimum desired objectives, i.e. beating inflation over the mid to long term.”

He continued: “We expect the historical dispersion in long-term returns among corporate pension funds in Spain will further widen. This dispersion is very clear between funds with more diversified and global investment strategies, and those with more local, i.e. European, strategies.”

According to Bellavista, as of mid-March 2020, the parameters favouring diversified and global strategies are again performing better: better equity performance for non-eurozone assets – especially emerging markets – better fixed income performance, better returns for alternative portfolios, and the dollar acting as a safe haven.

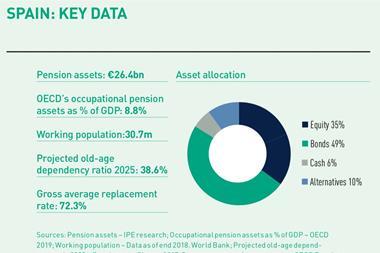

Meanwhile, according to Inverco, non-domestic equities continued to be the largest asset class for pension funds as a whole, with a slight increase in allocation to 23.2% of assets over the fourth quarter. The equity allocation remained stable at 36.4% of assets.

Fixed income overall fell over the fourth quarter, to 45.3% of portfolios. While Spanish government bonds continued to decline in terms of importance they still formed 20% of assets.

A further 14.8% was in Spanish corporate bonds, with 10.5% in non-domestic fixed income.

Inverco said that, at the end of December, total assets under management for the Spanish occupational pensions sector stood at €35.7bn, an increase of 5.6% over the past year.

The number of participants in the occupational system fell slightly over the same period, to just under 2 million.