Swiss pension funds are applying higher interest rates on members’ savings as a result of solid investment returns and funding ratios, but with falling yields on government bonds they might not be able to fully pass on gains to members.

Stephan Skaanes, chief executive officer at consultancy PPCmetrics, told IPE that pension funds will be able to pass on the entire performance as interest rate on savings in rare cases because interest rates on bonds have fallen significantly.

The yield to maturity on 10-year government bonds in Switzerland has collapsed to around 0.2% per year.

“This means that it will be very challenging for pension funds to generate the statutory minimum interest rate of 1.25% and the technical interest rate of approximately 1.75% (used to discount liabilities) on average in the future,” he added.

Meanwhile, Swiss multi-employer pension fund Asga Pensionskasse is applying a 4.5% interest rate on pension assets saved by members, up from 1.75% in 2023, it said. This means that over CHF700m (€755m) will flow into members’ retirement savings, it added.

Asga’s board of directors decided to lift the interest rate on savings after reviewing its good performance this year, and a funding ratio of 119%.

The interest rate on the savings of members of the fund for the canton of Solothurn (Pensionskasse Kanton Solothurn, PKSO) is 4% this year, the highest in more than two decades, as a result of a positive investment performance recorded in 2024, the scheme said in a statement.

At the same time, the increasing interest rate makes an important contribution to cushion the effects of the reduction of the conversion rate used to calculate pension payouts, said Emmanuel Ullmann, CEO of PKSO.

The pension fund has also announced that positive performance and a robust funding ratio make it possible to pay out a one-off sum of CHF600 to all retirees next summer.

PK SBB – the pension fund for Swiss federal railways – is applying an interest rate of 4.5% for members still working, while offering a one-off additional payment due to inflation to retirees, it said.

The pension fund for small and medium-sized firms, PKG Pensionskasse, said it had doubled the interest rate on savings, from 2.5% in 2023 to 5% in 2024, while the conversion rate used to calculate payouts remains at 5.2%.

Skaanes said: “The interest rate reflects the currently very good performance of Swiss pension funds. As of December, pension funds had a performance of around 9% year-to-date.”

He added: “Pension funds with a high allocation to equities, and a high share of liquid investments, achieved the highest performance. Pension funds with a high allocation to Swiss equities achieved lower returns than pension funds with a high share of international equity investments.”

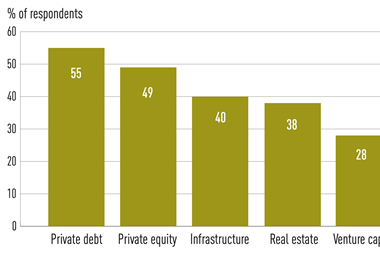

Illiquid investments such as private equity or direct real estate investments could not keep up with the returns of liquid investments, Skaanes added.

Pension funds with higher returns pay better interest rates only if they have full reserves set aside to fend off market fluctuations, and this is not yet the case for all pension funds, Skaanes said.

The latest digital edition of IPE’s magazine is now available