Sponsored commentary from ACTIAM

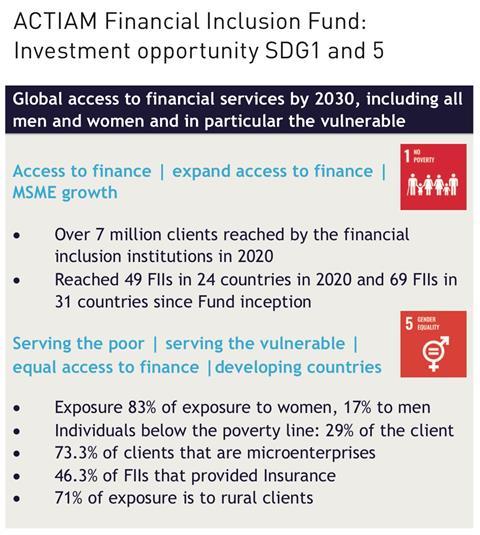

Impact investing is trending. The International Finance Corporation (IFC) estimates that investor appetite could grow to USD 26 trillion, with as much as USD 5 trillion of that in private markets. Looking at the market size of impact investing, the Global Impact Investing Network (GIIN) currently estimates that it was USD 715 billion at the end of 2019, with private debt attracting the highest capital allocation (34%). The huge gap between potential demand and the current market size shows that there is great potential for the impact investing market to grow.

Impact investing is expected to play a pivotal role in channeling private capital into projects and companies that could help to address key social and environmental challenges. As we begin to emerge from the COVID-19 pandemic, investors are also looking for a measure of certainty. With low interest rates not expected to rise any time soon, and continued stock market volatility, it comes as no surprise that alternative investment options are at the forefront of many minds.

CHALLENGES IDENTIFIED

Despite the huge appetite for it and the pivotal role it could play, it seems that investors are facing great challenges preventing them from allocating to impact investing.

At the moment the market is still lacking sustainable benchmarks and standardized data (collection and measurement),

Furthermore, after obtaining soundings from (Dutch) institutional investors, other challenges seem :

1. lack of scale;

2. lack of knowledge/capacity;

3. no place in the allocation policy;

4. high costs; and

5. illiquidity (high capital charge).

CHALLENGE 1: LACK OF SCALE

COVID-19, EU legislation and the new pension regulations are expected to create an enabling environment for the impact investing landscape to scale-up.

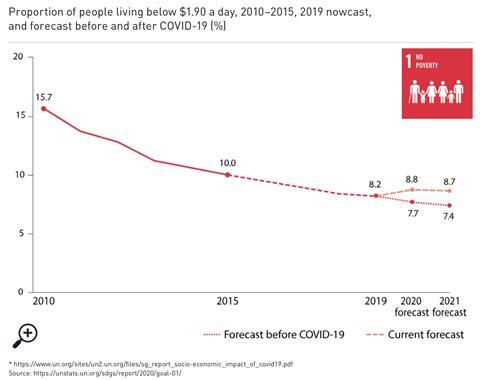

The UN (2020) has projected that COVID-19 will negatively affect almost all the SDGs. Severe long-term effects could push an additional 207 million people into extreme poverty on top of the current pandemic trajectory, bringing the total to over 1 billion by 2030. We believe that investors can play a key role in contributing to achieving these SDGs by 2030.

CHALLENGE 2: LACK OF KNOWLEDGE

The top four greatest challenges indicated in the GIIN 2020 survey (risk of impact washing, inability to compare impact, lack of transparency and lack of uniform impact language) are at the heart of EU legislation.

The Level I requirements of the SFDR, set out sustainability disclosure requirements. It was enacted to address i) increasing the transparency of sustainability-related disclosures, and ii) increasing comparability for end investors. In Level II, the Regulatory Technical Standard (RTS), this is taken to the next level. It comprises a whole list of disclosure requirements, but we would like to highlight two which contribute to increased transparency and comparability: i) sustainable investments in article 9 products with (an) environmental objective(s) should be sustainable according to the EU taxonomy, and this should be substantiated and disclosed; ii) financial market participants should disclose a minimum set of standardized and comparable relevant quantitative and qualitative indicators to show how each financial product meets the environmental or social characteristics that it promotes or the sustainable investment objective.

SFDR and RTS are expected to contribute strongly to the new paradigm of the triple helix of risk-return-impact, moving away from the current concept of risk-adjusted return. By making the integration of sustainability risks and their impacts on the financial return, the adverse impact and the (net) positive impact alongside risk-adjusted return mandatory throughout the investment process, this is expected to lead to other investment decisions going forward. At the same time the first steps are taken to increase transparency, comparability and combating so called ‘impact washing’.

CHALLENGES 3, 4 AND 5: NO PLACE IN ALLOCATION POLICY, HIGH COSTS AND ILLIQUIDITY

The new Dutch pension agreement is an example of how new pension systems will have consequences for asset allocation. It will become more personal and transparent, moving from a defined benefit (DB) to a defined contribution system (DC). It will become increasingly important for pension funds to seek more alignment with their beneficiaries. By targeting certain impact themes and SDGs, reflecting the interests of beneficiaries, this alignment can be increased and can act as a catalyst, to become future proof.

In a nutshell, there seem to be three main drivers in the new pension agreement which could contribute to overcoming the hurdles of no place in the allocation policy, high costs associated with impact investments and illiquidity (high capital charge).

- The biggest game changer is that there will be no capital charge (equity) requirements anymore. We believe that this will create significantly more room for alternative illiquid private debt investments. Removing this capital charge tackles an important hurdle, allowing illiquid investments to take a place in the allocation policy.

- Pension funds will be required to measure their members’ risk tolerance and adjust their investment mix accordingly. This is expected to pave the way for an investment mix that could contain pockets with higher risk.

- Diversification remains a cornerstone offered by private debt impact investments while also meeting sustainability criteria.

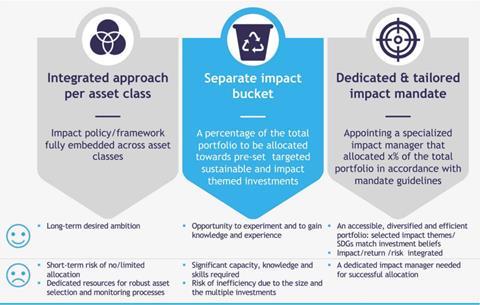

FROM INTENTIONALITY TO ALLOCATION

The most appropriate impact strategy to be pursued will be highly dependent upon size, the experience and skills already gained and whether impact investments have already been pursued. We believe that staying true to your (beneficiaries’) core values is key to being future proof.

- Express intention and commitment: what additional steps can you take to realise the SDGs?

- Gain insights into the preferred impact themes and SDGs of the ultimate beneficiaries.

- From policy to allocation: implementation into the strategic asset allocation.

- Allocation to implementation: once starting points have been defined, the impact themes, impact goals and associated theory of change can be determined per category.

CONCLUSION

- Impact investing is here to stay, and it is expected to experience a demand and supply boost in the following decade.

- The most recent developments contribute to overcoming the greatest global challenges faced and creating a sense of urgency to increase capital flows.

- By integrating the paradigm of the triple helix of risk-return-impact into the investment decision process, we believe that impact investing can contribute positively to asset diversification, lower overall volatility and reduce the effect of negative externalities.

Read the full article on https://www.actiam.com/en/investment-solutions/future-proof-investments-impact-investing/

Would you like to find out more about financial inclusion impact investing, please contact Romée van Wachem (Senior Relationship Manager Impact Investing): romee.vanwachem@actiam.nl

Disclaimer

ACTIAM is registered with and licensed by the Dutch Authority for the Financial Markets as manager of alternative investment funds. ACTIAM N.V. has its registered office in Utrecht and is entered in the trade register of the Chamber of Commerce (number 30143634). Nothing on this profile page should be considered as an offer, advice or an invitation to buy or sell any investments, in any jurisdiction where it would be unlawful to do so.