Sponsored Commentary from BNP Paribas Asset Management

It’s never been more important for the financial sector, including the investment industry, to take steps to help safeguard the planet’s threatened biodiversity. ESG analyst at BNP Paribas Asset Management, Robert-Alexandre Poujade explores the areas in which investors can make a difference.

As can be seen in most nature documentaries today, biodiversity is facing a crisis. As we enter the UN Decade of Ecosystem Restoration with a deadline of 2030 to turn around ecosystem degradation and meet the UN Sustainable Development Goals (SDGs), time is of the essence.

Governments have failed to meet any of the goals to prevent wildlife and plant loss set in 2010. The one-year delay for the UN’s COP 15 biodiversity conference – originally set for last October – means it’s even more important for the private sector to help address the problem.

There is good reason to do so. Aside from the intrinsic value of biodiverse, functioning ecosystems, they underpin a lot of our activities. The UK’s landmark Dasgupta Review on the economics of biodiversity outlines that our long-term prosperity relies on rebalancing our use of ecosystem services such as pollination, flood protection and CO2 sequestration, and nature’s capacity to supply them.

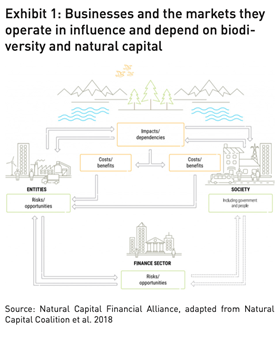

As the Natural Capital Finance Alliance’s Beyond ‘Business as Usual’: Biodiversity Targets and Finance report notes, half the world’s GDP depends at least moderately on a form of ecosystem service. The degradation of these services creates significant risk for financial institutions: from lower returns, risk of defaults to rising insurance liabilities. Put simply, ecosystem collapse will result in economic collapse.

Where to focus action?

These risks present opportunities. The financial sector can play a fundamental role to guide the trillions of dollars needed to preserve and restore ecosystems. Doing so can unlock multiple co-benefits. It’s important to note that biodiversity preservation can go hand in hand with effective climate change mitigation and adaptation efforts.

Financial services companies can help by incorporating biodiversity into wider financial strategies, but also by setting biodiversity disclosure, reporting and loss targets – particularly for priority industries that either depend on functioning biodiversity or whose activities significantly affect it.

The Natural Capital Finance Alliance lists these sectors as a priority for investors:

• Agricultural products

• Apparel, accessories and luxury goods

• Brewers

• Distribution

• Electric utilities

• Independent power producers and energy traders

• Mining

• Oil & gas exploration and production

• Oil & gas storage and transportation

Adequately integrating biodiversity into measuring performance on environmental, social and governance criteria and ESG reporting can help prevent misallocations of capital. Initiatives such as the upcoming Taskforce on Nature-related Financial Disclosures can give further support.

There are significant opportunities for investors across ecosystems:

Life on land

Land use pressures from activities including food production, which are the focus of the UN’s SDG 15, can significantly affect biodiversity in terrestrial ecosystems. Chatham House notes that the global food system is the main cause of habitat loss.

There are knock-on effects – research estimates global food systems end-to-end are responsible for 34% of greenhouse gas emissions, which in turn harm biodiversity through accelerating global warming.

There are opportunities to change the global food system for the better. Technology can play a large part – for instance, companies can use satellite data to check suppliers’ impacts on deforestation. Intervention can speed up the restoration of logged tropical forests and result in faster CO2 sequestration. Drones can map forest areas and even support restoration by releasing seeds.

Traceability in the food supply chain is another area seeing substantial innovation. For products such as coffee, blockchain can help consumers and other stakeholders identify the producers and their sustainability practices, while improving transparency.

How we generate our energy can have a significant effect on biodiversity – even renewables can have their impact. As research has recently indicated, solar farms, for example, can be integrated in a way that has a positive impact on local biodiversity.

Below the surface

Aquatic ecosystems – targeted by SDG 14 – are under pressure from pollution, warming waters and overfishing. It’s important to reduce these pressures: alongside sustaining the lives of billions of people through food provision, the oceans and the species within them have a fundamental role in the global carbon cycle to help regulate temperatures on Earth.

While large global initiatives such as the High Level Panel for a Sustainable Ocean Economy seek to regenerate ecosystems around the world’s coastlines, there are significant opportunities for investors in areas including plastic waste reduction, offshore wind, wave and tidal power, sustainable aquaculture and alternative shipping propulsion technologies.

Sustaining habitats such as seagrass meadows can contribute to biodiversity and carbon sequestration. Interestingly, such ecosystems can provide ecosystem services such as removing plastic from the ocean. There are opportunities to reduce plastic production or develop technologies to prevent waterways from taking plastics and micro-plastics into the ocean.

Within our cities

Greening cities, home to the majority of the world’s population, can help sequester CO2 while improving urban air and overall wellbeing. Research suggests the lack of biodiversity in cities could affect human health by limiting the microbes individuals are exposed to, hindering their immune systems’ ability to fight disease. So, there are health-related benefits from preserving biodiversity.

There are significant opportunities to improve air quality and reduce operational and embodied carbon through natural and technological means in the building and transport sectors.

These are just some of the areas that the financial sector can shift capital to. To tackle biodiversity loss, timely action is of the essence to provide a better environment for people around the world, and the species they share it with.

For more on the serious challenges and opportunities that biodiversity loss presents, read Sustainable by nature: our biodiversity roadmap.

Steve Matthews has managed liquidity funds since 2002. He currently manages £5bn in short-dated bond and liquidity mandates.

Canada Life Asset Management manages £39.6bn† across fixed income, cash, equities, property, mortgages and multi-asset funds. It is owned by Great-West Life Co, which has over £1,129bn* consolidated assets under administration.

†AUM as at 31/03/21. *AUA as at 31/12/200

Disclaimer: The above view(s) represent our judgement as at the date of this presentation and may be subject to change without notice. This is for illustrative purposes only and should not be used as a basis for making any specific investment, business or commercial decisions. Past performance is not an indication of future performance. No assurance can be given that investment objectives will be achieved. Due to various risks and assumptions made in our analysis, actual events or results or the actual performance of the markets covered may differ materially from those described. BNP PARIBAS ASSET MANAGEMENT UK Limited, “the investment company”, is authorised and regulated by the Financial Conduct Authority. Registered in England No: 02474627, registered office: 5 Aldermanbury Square, London, England, EC2V 7BP, United Kingdom. This material is produced for information purposes only and does not constitute: 1. an offer to buy nor a solicitation to sell, nor shall it form the basis of or be relied upon in connection with any contract or commitment whatsoever or 2. investment advice.This material is issued and has been prepared by the investment company. It contains opinions and statistical data that are considered lawful and correct on the day of their publication according to the economic and financial environment at the time. This document does not constitute investment advice or form part of an offer or invitation to subscribe for or to purchase any financial instrument(s) nor shall it or any part of it form the basis of any contract or commitment whatsoever. This document is provided without knowledge of an investors’ situation. Prior to any subscription, investors should verify in which countries the financial instruments referred to in this document refers are registered and authorised for public sale. In particular financial instruments cannot be offered or sold publicly in the United States. Investors considering subscriptions should read carefully the most recent prospectus or offering documents and/or Key Investor Information Document (KIID) agreed by the regulatory authority, available on the website. Investors are invited to consult the most recent financial reports, which are also available on the website. Investors should consult their own legal and tax advisors prior to investing. Given the economic and market risks, there can be no assurance that the financial instrument(s) will achieve its investment objectives. Their value can decrease as well as increase. In particular, changes in currency exchange rates may affect the value of an investment. Performance that is shown net of management fees and is calculated using global returns with time factored in, with net dividends and reinvested interest, and does not include subscription-redemption fees, exchange rate fees or tax. Any gross of fees performance included in this material do not reflect the deduction of commission, fees and other expenses incurred. Returns will be reduced after the deduction of such fees. Past performance is not a guarantee of future results. This document is directed only at person(s) who have professional experience in matters relating to investments (“relevant persons”). Any investment or investment activity to which this document relates is available only to and will be engaged in only with Professional Clients as defined in the rules of the Financial Conduct Authority. Any person who is not a relevant person should not act or rely on this document or any of its contents. All information referred to in the present document is available on www.bnpparibas-am.com As at September 2021.