All Country Reports – Page 3

-

Country Report

Country ReportSwitzerland country report 2024: The trouble with Swiss second-pillar pension reform

Attempts to reform occupational pensions continue to fail, risking undermining public trust. But pension funds have already been making their own pragmatic changes

-

Country Report

Country ReportSpanish country report 2024: Pension funds eye a new rate environment

Buoyed by strong returns, pension funds have been lengthening the duration in their fixed-income portfolios

-

Country Report

Country ReportIs Switzerland’s pension system facing a crisis following referendum on reform defeat?

In a referendum in September, Swiss voters rejected proposals to reform the supplementary pension system, known as BVG in German.

-

Country Report

Country ReportLower interest rates see Swiss pension funds adjust asset allocations

Lower rates are nudging Swiss pension funds to rethink their approach to fixed income and private markets

-

Country Report

Country ReportTransition strategy one step at a time

Pension funds and asset managers are upping their game when it comes to the transition to a low-carbon economy

-

Country Report

Country ReportNetherlands country report 2024: Dutch pension funds distribute buffers

The arguments heat up over what to do with excess funds in Dutch pension schemes

-

Country Report

Country ReportTwo Dutch pension funds outline plans for defined contribution transition

Two schemes explain how they intend to transform into DC plans.

-

Country Report

Country ReportNew Netherlands coalition government agrees to disagree over pension reform

The reform of the Dutch pension system is likely to go ahead as planned by the previous government

-

Country Report

Country ReportFrench workplace pensions grow as reform controversy recedes

Macron’s controversial pension reforms look likely to survive, at least for now, and despite the political turmoil of the recent elections

-

Country Report

Country ReportChanging of the guard at France's buffer fund FRR

Fonds de réserve pour les retraites has had a management and investment refresh

-

Country Report

Country ReportUnderstanding France’s new second-pillar regime

IORPs have now taken root in France as providers have shifted from the previous insurance-based regime, but allocations to fixed income remain high

-

Country Report

Country ReportItaly Country Report 2024: How local pensions could support the economy

The Italian pension industry and policymakers are discussing ways to channel more pension investment towards the country’s business sector

-

Country Report

Country ReportItalian pension funds fine-tune asset allocation

Growing appetite for private market investments, amid shifting equity and bond portfolios, are keeping Italian pension funds busy

-

Country Report

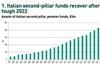

Country ReportSlow growth for Italy's second-pillar pensions

Despite the urgency of increasing second-pillar coverage, policymakers continue to focus reform efforts on public pensions

-

Country Report

Country ReportCDC pension fund benefits from a steady stream of young members

The Cassa Dottori Commercialisti (CDC) is one of the most sustainable casse di previdenza, the Italian privatised first-pillar funds for professionals, thanks to prudent asset allocation and the CDC’s policy to attract young Italians to the chartered accountancy profession.

-

Country Report

Country ReportENPAM looks to preserve cash flow

In February 2024, the board of ENPAM, the first-pillar pension fund for doctors and dentists, approved plans for the fund to transition to an asset liability management (ALM) model that will focus on liability-driven investment (LDI).

-

Country Report

Country ReportPrevimoda fine tunes for better results

In 2023, Previmoda, the pension fund for the fashion and textile sector, rejigged the strategic asset allocation of its sub-funds Smeraldo Bilanciato, which has a higher exposure to fixed-income, and the equity-focused Rubino Azionario.

-

Country Report

Country ReportNordic Region Report 2024: Denmark’s government urges pension funds to support defence

Danish schemes embrace defence – as long as ESG criteria and international conventions are adhered to

-

Country Report

Country ReportSweden’s AP7 adapts by expanding asset classes and boosting staff numbers

Under new leadership, Sweden’s default fund in the premium pension system is expanding asset classes and personnel

-

Country Report

Country ReportSolvency rules continue to hamper Finland’s private pension funds

The Finnish retirement industry hopes that a relaxation of regulations will allow schemes to increase equity allocations