All Country Reports – Page 7

-

Country Report

Country ReportCountry Report – Pensions in UK (May 2023)

UK pensions are at a crucial juncture. The UK Parliament’s inquiry into the LDI crisis of September 2022 shed some light on its causes, but the debate on the role of LDI is alive and well. Meanwhile, regulators including The Pensions Regulator and the Financial Conduct Authority have advised pension schemes on how to make LDI strategies more resilient to shocks.

-

Country Report

Country ReportUK: A review of the LDI debacle

The UK Parliamentary inquiry into the LDI crisis has shed light on its causes, but the debate over the lessons learned for the UK DB industry is far from over

-

Country Report

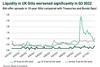

Country ReportUK: to barbell or not to barbell?

In the new world of lower LDI leverage, trustees must choose between maintaining hedging or diversification

-

Country Report

Country ReportUK: Can the country turn a flawed investment ecosytem around?

Decades of complex legislation has fuelled many unanticipated consequences, which has seen pension funds invest less in riskier listed equities and illiquid assets

-

Country Report

Country ReportUK: Beware the unintended consequences of the DB funding code

Laura McLaren highlights the unintended consequences of TPR’s proposed code, and what can be done to mitigate the risks

-

![Ewan McCulloch (7)[33]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/6/1/3/138613_ewanmcculloch733_634858_crop.jpg) Country Report

Country ReportUK: Is it too soon to reform pension pools?

In his March 2023 Budget, UK chancellor Jeremy Hunt challenged the Local Government Pension Schemes (LGPS) in England and Wales to “move further and faster on consolidating assets”, proposing that LGPS funds transfer all listed assets into their pools by March 2025.

-

Country Report

Country ReportUK: The case for pooling

Successful pooled schemes such as Border to Coast should be open to other clients because they are good at what they do

-

Country Report

Country ReportUK: DC investment won't be a panacea for tech and science

The UK government’s March Budget contained plans to boost investment in high-growth industries such as digital, life sciences and advanced manufacturing, so they can start, scale up and remain in the UK.

-

Country Report

Country ReportUK: Schemes must prioritise members

Pension funds are encouraged to invest in UK illiquids, but it cannot come at any cost

-

Country Report

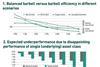

UK: One way for DC schemes to access private markets

There is much debate about mark-to-model valuation methodologies and whether a material economic downturn will cause these to catch up with public market price falls, but the history books will show that portfolios with allocations to private markets were more robust than those with none in 2022 – the worst year on record for traditional balanced portfolios.

-

Country Report

Country ReportCountry Report – Pensions in the Netherlands (April 2023)

The Netherlands is in the final legislative stages of what will probably be the largest and most complex workplace pension system change ever in the world. Yet as it edges towards the parliamentary finishing line, recent political events could yet knock the process off course.

-

Country Report

Country ReportNetherlands: Pension overhaul nears another milestone

The law to reform Dutch pensions has finally been approved by the Dutch lower house, but the switch from DB to DC still needs to clear one hurdle – the Senate

-

Country Report

Country ReportNetherlands: Early birds gear up for DC switch

The pension funds for pharmacists and librarians will be among the first to move to the new DC system. They talk to Tjibbe Hoekstra about the pros and cons of being an early mover, and discuss how the new system will impact their investment strategies

-

Country Report

Country ReportNetherlands: A bad year for performance

Most Dutch pension funds suffered double-digit losses in 2022

-

Country Report

Country ReportNetherlands: Interview with Agnes Joseph

The current timetable leaves no margin for error, Achmea’s Agnes Joseph tells Tjibbe Hoekstra

-

Country Report

Country ReportCountry Report – Pensions in Germany (March 2023)

Angela Merkel’s governments largely dodged the political hot potato of first-pillar pension reform, which means the current overhaul to the state system is overdue. But it barely gets to grips with the issues. For one, it does not deal with entitlements or increase the retirement age; second it introduces a funded component that will probably only take effect in the 2030s, when the post-war demographic peak is passing.

-

Country Report

Country ReportGermany: First pillar pension reforms in need of political and financial capital

Berlin’s new ‘Generationenkapital’ concept is intended to revamp the ailing first pillar but political consensus is lacking and more capital will be necessary to endow the planned state fund

-

Country Report

Country ReportGermany: Aba's perspective on pension reforms

Klaus Stiefermann, managing director of the German occupational pension association Aba, tells Luigi Serenelli about the main proposals to change the pension system

-

Country Report

Country ReportGermany: Viewpoints on corporate pension proposals

IPE asked leading practitioners for a progress report on company pensions

-

Country Report

Country ReportGermany: Financing the Energiewende

German professional pension funds like ÄVWL and BVK are keen to support the energy transition process