Andrew Capon

Asset Class Reports

Asset Class ReportsThe green bond imperative

A deepening pool of green bond issuance is allowing investors to direct capital towards objectives like energy transition

Special Report

Special ReportNextGenEU: Towards a new euro yield curve?

Bonds designed to support member states hit hardest by the pandemic look set to become a new safe asset

Features

FeaturesBriefing: The sustainability missing link

Love him or loathe him, no one can doubt that Tesla CEO Elon Musk has a penchant for self-publicity and a talent for disruption in industries from automobiles to space. He has lately taken an interest in the metals and mining sector. In June, he tweeted that he would provide a “giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way”.

Features

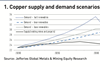

FeaturesNet-zero opportunities: Global green momentum boosts prospect of a mining super cycle

The Covid-19 pandemic has given everyone pause for thought. It has also been a catalyst for action. For some, global warming seemed like a nebulous, distant concern. But the fragility of life on earth has been laid bare.

Features

FeaturesInflation strategy: Conditions look ripe for a new commodities supercycle

The media briefly got excited when the followers of Reddit – a social news website often used by political activists – ineffectually attempted to ramp up silver prices in February. But news about commodity prices other than oil and gold rarely make headlines. For most institutional investors, commodities are a Cinderella asset class. A fleeting moment in fashion before the 2008 global financial crisis (GFC) has been superseded by widespread indifference.