Last year saw a headline reduction in global assets under management (AUM) of €6trn (-5.5%), according to IPE’s latest analysis of the investment management industry. This year’s IPE Top 500 Asset Managers 2023 research exercise took in 594 firms globally, employing some 67,000 investment professionals.

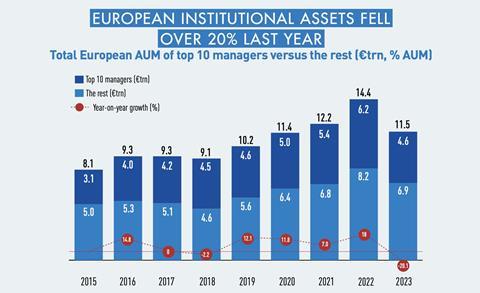

This represents the first reduction in assets since 2018, when there was a much milder -2.2% drop in gross global AUM. Assets grew by 18% in 2021, capping four straight years of year-on-year increases.

Total European institutional AUM fell by 20.1% over 2022, to €11.5trn (from €14.4trn) – touching the level seen at end-2020 (€11.4trn). Institutional assets globally fell by 16.2%. The share of European institutional passive assets held steady, at 21% of the total. Globally the figure is 27%.

George Walker, Neuberger Berman’s chief executive officer, told IPE: “Most firms are responding to the economic headwinds of 2022-23, with its reduced revenues (and typically net outflows from clients), with cuts in headcount, office footprint, research data costs, travel, and compensation, likely spread across 2022 and 2023.”

The CEO emphasised Neuberger Berman was on a “different path” with a 2% revenue increase in 2022.

Earller this year, T. Rowe Price reported 2022 revenues down 15.% in dollar terms, while Invesco reported revenues down 15%. Franklin Resources, the parent of Franklin Templeton, reported 12-month revenues to end-March 2023 down 9.2%. Amundi reported 2022 revenues up 2% (in euro terms). DWS reported an increase of 0.5% over the same period.

Despite net inflows of over $300bn (€$287bn) in 2022 and positive organic fee growth, BlackRock reported a reduction in revenue of 8% last year, and reduced headcount by 2.5% of its global workforce over 2022. Goldman Sachs Asset Management and Insight also saw significant net inflows over 2022, the latter shrugging off the effects of the UK LDI crisis of last autumn.

Data highlights from IPE’s 2023 Top 500 Asset Managers report

• Global AUM: €102.6trn

• Year-on-year change: -5.5%

• Global institutional assets: €35.1trn

• Year-on-year change -16.2%

• European institutional assets: €11.5trn

• Year on year change: -20.1%

Leading executives also outlined their views on key challenges for the asset management sector. Most affirmed their support for ESG. Christoph GirondeI, deputy CEO of Nordea Asset Management, said: “I believe ESG is a long-term incontrovertible trend, and demand for sustainable investments is set to increase for the next three to five years.”

Walker of Neuberger Berman said: “During 2022, the debate around ESG became highly politicised, especially in the US. However, that does not remove investors’ need to manage material ESG risks, or the return opportunities that sustainable business models can offer.”

Nicholas Moreau, CEO of HSBC Global Asset Managers, said: “The asset management industry is undergoing a transition phase, in which those who reinforce their commitment to sustainability and adopt a transformational approach to investment stewardship will emerge as industry leaders.”

IPE’s data shows a trend towards increasing headcount of ESG specialsts – with a 13% increase in the total last year. The average number of ESG specialists per reporting company is now 15, up from 12 last year. However, the largest firms appear to be pulling ahead with a marked increase in average headcount in the €1trn-plus AUM category.

Regarding AI, Christian Staub, Europe managing director at Fidelity, said that “while a number of tasks in the investment management industry could be enhanced by generative AI, we believe there is still a way to go before this technology – or others such as blockchain, natural language processing or machine learning – reaches the highest standards required by the industry”.

JP Morgan Asset Management EMEA CEO Patrick Thomson said: “There are many reasons to remain optimistic about the dynamics of the sector and, in my view, asset managers who are leaders in technology today will be the asset management leaders of tomorrow.”

Research for IPE’s annual research exercise took place between February and June 2023.

The full IPE Top 500 Asset Managers report is available free for IPE Gold subscribers. Click here to find out how you can gain access to the data