Asset Managers

In-depth reporting on asset managers for our pension fund and asset management readers from IPE’s award-winning journalists

-

News

NewsNZAM: Which asset managers have stuck and which ones have left

Most Net Zero Asset Managers initiative members stay on after overhaul, but major names remain absent

-

News

NewsRelaunch of NZAM sees most asset managers doubling down on net zero

Members must ‘commit to support investing aligned with the global goal of net zero greenhouse gas emissions’

-

News

NewsSchroders, JP Morgan among US, UK winners in Swedish FTN’s biggest tender

Big ticket sizes was key in attracting the best asset managers for premium pension savers, Swedish agency says

-

News

NewsAP7 to pilot test wider insourcing of SEK1.36trn passive portfolio

Geopolitical situation is one of the reasons behind Swedish pensions giant’s move to bring lion’s share of equities in house

-

News

NewsNuveen-Schroders deal to create eighth largest European institutional manager

Nuveen is proposing to buy Schroders for around £9.9bn in cash

-

News

NewsManager expectations of a disorderly climate transition rise

LCP survey also found that a third of surveyed managers are unsure whether ESG initiatives such as NZAM will play significant role in investment industry

-

News

NewsE.ON UK pension fund appoints Schroders Solutions as principal investment manager

Schroders Solutions has overall control of the group’s investments, both through direct asset management and by appointing external investment managers

-

News

NewsAsset owners urge asset managers to continue NZAM involvement

Participation in Net Zero Asset Managers an ‘important and public signal’ for us, say 40-plus asset owners in statement

-

News

NewsERAFP brings forward end date for qualified fossil-fuel debt financing

The French fund’s announcement of a tighter fossil fuel policy comes after FRR updates its exclusions for unconventional hydrocarbons and thermal coal

-

Opinion Pieces

Opinion PiecesCulture is now too important to leave informal

The institutional investment market needs to consistently evidence its beliefs about culture, argues Bev Shah, co-CEO at City Hive

-

Analysis

AnalysisIPE Netherlands Briefing: Another 24 funds convert to defined contribution

Plus: Pension funds divest from US assets; PME withdraws €5bn mandate from BlackRock

-

News

NewsLPPI looks to hire Brunel staff in next step of LGPS consolidation

The pool was previously rumoured to be a contender to take on Brunel Pension Partnership’s investment infrastructure

-

Research

ResearchIPE institutional market survey: Fiduciary, OCIO & outsourcing 2026

IPE’s annual fiduciary management, OCIO and outsourcing survey covers packaged advice and implementation services provided by investment management or consultancy firms to institutional investors.

-

Research

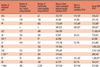

ResearchIPE institutional market survey: Investment grade credit managers 2026

European institutions have been stockpiling investment grade credit, according to this year’s survey of assets held in IG credit strategies. The headline figure for the European institutional segment shows a 27% increase from last year’s survey to €1.63trn.

-

Research

ResearchIPE institutional market survey: Managers of Swiss institutional assets 2026

Domestic managers top our ranking, in terms of AUM, of the leading managers of Swiss institutional assets. However, UBS Asset Management is the undisputed leader, following the acquisition of Credit Suisse by UBS, and the onboarding of Credit Suisse’s institutional clients.

-

Interviews

InterviewsLazard Asset Management 's Jeremy Taylor: “The shape of the market has completely changed”

Lazard Asset Management makes a strong case for fundamental research and active management, Europe co-CEO Jeremy Taylor tells Carlo Svaluto Moreolo

-

News

NewsEQT to buy Coller Capital for up to $3.7bn to drive secondaries growth

The deal is expected to be mid-single-digit accretive to EQT’s fee-related earnings

-

News

NewsPGIM launches private credit secondaries push with $1bn target

The platform will focus on sourcing opportunities in direct lending as well as opportunistic credit areas, including mezzanine and special situations

-

Analysis

AnalysisDid sustainability collaborations fail in 2025?

Investor climate alliances retreat or collapse under antitrust pressure, forcing collaboration to evolve rather than disappear

-

News

NewsESMA: Fossil fuel holding changes suggest fund naming guidelines effective

Fund managers are more likely to rebrand their funds when faced with higher divestment needs to comply with the rules, supervisor finds