British International Investment (BII), the UK’s development finance institution, has announced the shortlist of finalists from its call for proposals to accelerate climate finance into emerging markets and developing economies.

The judging panel of industry experts included Mark Fawcett, chief executive officer of NEST Invest, and Faith Ward, chair of the Institutional Investors Group on Climate Change (IIGCC) and chief responsible investment officer at Brunel Pension Partnership.

“I am pleased to have joined the judging panel of this important initiative to unlock value in climate finance across emerging markets and developing economies,” said Fawcett, who is also participating in another emerging markets-focused sustainable investment initiative, the government-convened EMDE Investor Taskforce.

“I am particularly impressed by the sophistication and innovation of the proposals, which demonstrated the UK is in a strong position as global leader to mobilise capital towards sustainable investment opportunities across these markets.”

Launched under BII’s £100m (€115m) mobilisation facility and delivered in partnership with Mercer, the call for proposals attracted 27 proposals from a diverse pool of asset managers, banks, fund managers and impact investors.

The shortlist

Five entrants have been shortlisted: Amundi, BlueOrchard, Finance in Motion, Standard Chartered and an unnamed “climate-focussed fund manager”. A BII spokesperson told IPE the fifth finalist didn’t want to be named until the end of the process.

“Shortlisting proposals for the BII mobilisation competition was a tough ask, given the array of innovative and inspiring responses,” said Brunel’s Ward.

“The proposals clearly illustrated the enthusiasm and creativity the financial sector can offer in catalysing investment in climate solutions and resilience in emerging markets.”

The shortlisted entities will now proceed to the next stage of the BII’s investment committee process, and up to three will be selected to receive funding from a £50m allocation available under the mobilisation facility. The development finance institution hopes to also be able to invest from its balance sheet.

“It was further reinforcement that we weren’t crazy when we were seeing this set of archetypes in the market from our portfolio historically”

Sarah Marchand, director, capital solutions at BII

The judging panel also comprised Ngalaah Chupi, founder of Taru Capital, and John Walker, chair of Eastpoint Partners, alongside BII staff.

Final decisions are expected in the final quarter of this year.

‘Risky’

Speaking at IPE’s Transition conference last month, Sarah Marchand, director, capital solutions, at BII, said the development finance institution took “a bit of a risk” in doing a call for proposal because the last one – more than 10 years ago – hadn’t gone that well.

But she said BII was very pleased with the outcome so far.

She said that 11 of the asset managers that pitched proposals were new to BII, helping it achieve its goal of engaging with a different type of asset manager, with several of them what BII would describe as truly commercial managers.

BII has a strong legacy as a fund-of-fund investor.

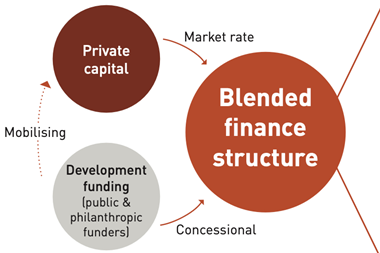

Most of the proposals were debt proposals, in keeping with the fact that BII is looking to use concessional capital to leverage five times as much commercial capital, Marchand explained. Most of them were mitigation-heavy, although some strategies had adaptation or resilience-oriented assets in the mix.

The majority (21) of the proposals BII received were for blended finance funds, which are becoming the most replicable and scalable blended finance vehicle.

Earlier this year, BII published a typology of blended finance funds archetypes to help make such funds easier and quicker to design and operationalise, and Marchand said it was encouraging that it was able to map the 21 proposals to the archetypes.

“It was further reinforcement that we weren’t just crazy when we were seeing this set of archetypes in the market from our portfolio historically,” she said.

Read the digital edition of IPE’s latest magazine