Asset Managers – Page 2

-

News

NewsStagecoach transfers £1.2bn pension fund to Aberdeen

Aberdeen will receive a minority share of any surplus generated

-

News

NewsPeople moves: Former SAMCo deputy CIO joins AustralianSuper

Plus: Railpen has appointed a new director of member experience

-

News

NewsPeople’s Pension adds to equity manager roster with £3.6bn EM mandate

Appointing Robeco represents a shift from a passive approach to an active quantitative strategy for UK pension fund’s emerging markets portfolio

-

News

NewsSweden’s FI launches probe into costly individual occupational pensions

Financial watchdog delivers government-mandated mapping report of pensions and investment costs

-

News

NewsEU, UK asset managers plan return to client-funded research budgets

Survey shows that vast majority of asset managers believe funding models based on commission-sharing arrangements will be in asset owners’ interests

-

News

NewsCommerzbank reshapes asset management in bid to drive further growth

The reorganisation involved the establishment of Commerz Real Capital as a new distribution company

-

News

NewsFTN doubles fee as tender work proves more laborious than expected

Sweden’s Fund Selection Agency to hike its tender fee from next year, while cutting annual monitoring fee for older funds

-

News

NewsXPS Group downgrades asset managers over weak climate pledges

Consultancy said asset managers should have clear firm-level targets to manage climate change “as a systemic issue”

-

News

NewsEuropean Commission publishes official plans for updated SFDR

Transition and impact categories in, adverse impact and taxonomy reporting loosened as regime set to move to a labelling framework

-

News

NewsOsmosis names CIO, strengthens quant capability as part of sustainable expansion strategy

Fadi Zaher, formerly LGIM’s head of index solutions, will take on the CIO role at Osmosis next April

-

News

NewsUK asset manager body asks for more tailored rationales for exec pay

But overall flexible approach is working well, says Investment Association

-

News

NewsIceland’s LV shifts entire foreign equities portfolio to segregated accounts

Pension Fund of Commerce completes three major investment management exercises - pooled funds to SMAs, new custodian, and SAA

-

News

NewsSwedish funds agency details upcoming US dual tender, unveils €7bn 2026 plan

FTN says next year’s plan includes procurements for SEK41bn US/North American equity funds, then healthcare/biotech funds and the first fixed income funds category

-

News

NewsState Street Investment Management snaps up minority stake in Coller Capital

Deal aims to broaden both firms’ reach and unlock new opportunities in the rapidly growing private capital secondaries market

-

Research

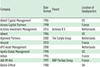

ResearchIPE institutional market survey: Global equities managers 2025

European institutional investors hold just shy of €2trn in global equities, up from €1trn in 2022. The assets held in global equities by European institutions have nearly doubled, no doubt thanks to the meteoric rise of equity valuations in the post-COVID years.

-

Research

ResearchIPE institutional market survey: Managers of Nordic institutional assets 2025

The assets managed on behalf of Nordic institutional investors have grown handsomely since the 2022 trough, increasing by almost 57%, while those managed on behalf of Nordic pension funds have grown by 50% over the same period.

-

Research

ResearchIPE institutional market survey: Private equity managers 2025

IPE’s annual survey of private equity firms, highlighting their assets under management, fund raising, and the areas in which they invest

-

Special Report

Special ReportMichael Pedroni: “The path forward for an asset manager is to engage with authentic, consistent communication about what serves investors best”

Global asset managers are under more public pressure than ever, as policymakers in disparate regions demand that fund managers fulfil multiple and often conflicting roles.

-

News

NewsEuropean asset owners launch Scaleup Europe Fund with EU Commission

APG Asset Management, Fondazione Cariplo and Novo Holdings, among others, are founding investors in the new fund

-

News

NewsSwedish agency invites tech fund tenders for €14bn premium pension savings

Procurement is Tumba-based agency’s third largest in terms of savers affected and amount of capital