All Country Report articles – Page 10

-

Country Report

Country ReportItaly: Struggles of the pension sector

Italian industry-wide pension funds fail to attract new members, with potentially serious long-term consequences

-

Country Report

Country ReportCountry Report – Pensions in the Nordic Region (June 2022)

We open our June Nordic Region report with a stark question: are asset managers living up to asset-owners expectations on ESG, in particular when it comes to climate change reporting?

-

Country Report

Country ReportNordic Region: Pension funds look to asset managers for climate action

Asset managers have been criticised for slow actioning of investors’ ESG policies

-

Country Report

Country ReportNordic Region: KLP fosters healthy start-up culture

The Norwegian pension fund’s accelerator programme teams up with CoFounder to help early-stage businesses with investment, advice and management

-

Country Report

Country ReportNordic Region: Dorrit Vanglo exit interview

For LD’s outgoing CEO, being mindful of working with other people’s money is key – as is a sense of humour

-

Country Report

Country ReportNordic Region: Sweden prepares for a pensions reboot

The Swedish Fund Selection Agency is set to take over the reins of the SEK 2trn premium pension system following a series of scandals

-

Country Report

Country ReportCountry Report – Pensions in the UK (May 2022)

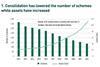

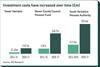

The 80-plus local government pension funds in England and Wales have been on course to consolidate into eight asset pools for the last six years, with a target of €1-2bn in cost savings by 2033.

-

Country Report

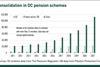

Country ReportUK: Auto-enrolment after a decade: broadening the scope

The UK is exploring how to bring younger, part-time, and lower paid workers into the scope of its successful auto-enrolment regime

-

Country Report

Country ReportUK: Behind the pooling figures for local government pensions

Comparing the cost savings of the eight local government pension scheme pools is a complex exercise

-

Country Report

Country ReportUK: Interview with Sally Bridgeland

Sally Bridgeland, chair of Local Pensions Partnership Investments, discusses the institution’s net-zero carbon emission and cost-reduction strategies

-

Country Report

Country ReportUK: Collective defined contribution pensions move up a gear

The first collective defined contribution pension scheme is set to launch after years of stop-start progress. But obstacles remain

-

Country Report

Country ReportUK: The long and winding road to consolidation

Brexit, COVID and other factors delay regulation that would enable commercial DB scheme consolidators to operate

-

Country Report

Country ReportUK: Pension dashboards make slow progress

DWP timeline is met with optimism but complex UK system throws up problems

-

Country Report

Country ReportCountry Report – Pensions in Germany & Austria (April 2022)

It took just over 100 days in office before Germany’s new coalition government announced a €500bn budget to first pillar pension financing, setting in motion an agreed reform process that would create a partially funded state pension system.

-

Country Report

Country ReportAustria: Political instability slows pension reform

The government continues to drag its feet on the comprehensive overhaul of second-pillar pensions

-

Country Report

Country ReportGermany: New government seeds new ideas on pensions

Germany’s traffic-light coalition aims to stabilise pensions and contribution rates as it seeks to endow a €10bn state global equity fund

-

Country Report

Country ReportGermany: Leading viewpoints on pensions policy

Senior pension figures and politicians spell out their priorities for German pensions

-

Country Report

Country ReportGermany: Rethinking the rules for Pensionskassen

Pensionskassen are still a reliable way to provide employees with occupational pensions but regulatory requirements must change

-

Country Report

Country ReportCountry Report – Pensions in The Netherlands (March 2022)

The nominal treatment of liabilities in the Netherlands’ FTK pension regulatory framework means schemes don’t need to explicitly hedge inflation. But Dutch inflation came in at one of the highest rates in the euro-zone in January, and there has been strong criticism in the last decade about pension indexation cuts.

-

Country Report

Country ReportAdministration: APG buys in from Dutch newcomer

Sameer van Alfen & Lieuwe Koopmans The Netherlands’ largest pension provider has opted to partner with a Danish provider in a move observers have hailed as ‘brave’