All IPE articles in February 2021 (Magazine) – Page 2

-

Special Report

Special ReportDevelopment banks evolve

Development banks are going beyond their traditional economic remit to embrace tackling climate change and meeting the UN’s Sustainable Development Goals

-

Features

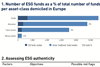

FeaturesBriefing: Tide turning for ESG fixed-income

The supply of ESG-aligned bonds is increasingly underpinned by regulatory pressures and client demand for products targeting non-financial objectives. As the investable universe grows, so the number of funds and assets will increasingly find their way towards fixed-income ESG solutions. However, to strike the right balance between financial and non-financial returns investors should look for ESG-authentic leaders with good risk-return capabilities

-

Opinion Pieces

Opinion PiecesLetter from US: HSAs set to build on popularity

The Health Savings Account (HSA) is becoming increasingly popular as a retirement savings vehicle in the US. The new Biden presidency and the now Democrat controlled Congress are likely to accentuate this trend in 2021 and beyond.

-

Special Report

Special ReportSpecial Report: European Pension Funds’ COVID Response

We also analyse how public development banks are going beyond their traditional remit, with a focus on post-COVID recovery, tackling climate change and meeting the UN Sustainable Development Goals.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: David Neal, IFM Investors

While COVID-19 continues to hit the global economy, governments are looking to infrastructure as a way to create future employment and sustain the eventual economic recovery

-

Country Report

Country ReportDB funding: Small rise in funding levels

Volatile financial markets continue to cause significant headaches for pension schemes

-

Opinion Pieces

Opinion PiecesThe pandemic end-game

Overcoming COVID-19 and ensuring no recurrence is proving to be a formidable challenge for the global economy. The worst may still lie ahead. Even health systems in developed markets are creaking at the seams with the second and third waves of the pandemic. More transmissible mutations of the virus are making the task even harder.

-

Interviews

InterviewsHow we run our money: Local Pensions Partnership

Chris Rule (pictured), CEO of the £19.7bn Local Pensions Partnership (LPP), speaks to Carlo Svaluto Moreolo about building an in-house investment management outfit

-

Features

FeaturesStrategically Speaking: Mondrian Investment Partners

Clive Gillmore is a rarity nowadays among asset management CEOs in that he is keen to discuss what he sees as the difficult moral choices embodied in ESG investment

-

Country Report

Country ReportA long and winding road

COVID-19 joins the line of obstacles slowing Irish pension reform plans

-

Features

FeaturesPerspective: Targeting net zero

Ambitious ‘net-zero’ carbon reduction goals are the latest in the evolution of asset owners’ engagement with climate change

-

Special Report

Special ReportOn the record: The path to recovery

Six major pension investors chart the risks and opportunities ahead as the world moves into a recovery phase

- Previous Page

- Page1

- Page2

- Next Page