Fiduciary Management

In-depth reporting on fiduciary management for our pension fund and asset management readers from IPE’s award-winning journalists - plus, fiduciary management special reports

-

News

NewsUK consultants launch asset owner-manager stewardship alignment tool

New tool is designed to help asset owners assess whether asset managers’ stewardship practices align with their expectations, offering suggestions where gaps emerge

-

News

NewsInvestment Association urges asset owners to rethink stewardship

IA report outlines six structural challenges and 10 recommendations for asset owners, investment managers, consultants, and regulators

-

Opinion Pieces

Opinion PiecesCulture is now too important to leave informal

The institutional investment market needs to consistently evidence its beliefs about culture, argues Bev Shah, co-CEO at City Hive

-

News

NewsHolcim Group picks Van Lanschot Kempen for £2.5bn fiduciary mandate

Trustees of Lafarge UK Pension Plan and Aggregate Industries Pension Plan pick Van Lanschot Kempen as new fiduciary manager

-

Research

ResearchIPE institutional market survey: Fiduciary, OCIO & outsourcing 2026

IPE’s annual fiduciary management, OCIO and outsourcing survey covers packaged advice and implementation services provided by investment management or consultancy firms to institutional investors.

-

Special Report

Special ReportFiduciary assets plateau as UK market matures

UK pension schemes are de-risking through insurance in growing numbers, while many are choosing run-on strategies – and fiduciary managers must adapt

-

News

NewsDutch social housing pension fund appoints Kempen as fiduciary manager

The €15bn pension scheme for the social housing sector was on the lookout for a new fiduciary since 2024

-

News

NewsXPS Group finds sharp decline in green ratings among fiduciary managers

Consultancy says trustees can no longer rely on statements alone, but need evidence of integration, escalation, and impact

-

News

NewsIceland’s LV shifts entire foreign equities portfolio to segregated accounts

Pension Fund of Commerce completes three major investment management exercises - pooled funds to SMAs, new custodian, and SAA

-

Special Report

Special ReportEasing the path for European institutions to launch securities litigation

Corporate scandals, tighter regulation and increased fiduciary duties have all boosted the numbers of pension funds seeking financial redress

-

News

NewsKPN pension fund invests €300m in private impact loans

M&G will manage the mandate, which will be at least 45% directed towards impact investments aligned with the fund’s climate, technology and consumption themes

-

Country Report

Country ReportNetherlands country report 2025: Is the fiduciary management outsourcing trend set to continue?

Time to throw in the towel? Now even established in-house teams are shutting up shop

-

News

NewsITN Pension Scheme picks Van Lanschot Kempen as fiduciary manager

The appointment contributes £250m to Van Lanschot Kempen’s total client assets under management

-

News

NewsGSAM pulls out of agreement to absorb third of Shell’s asset management staff

Shell and Goldman Sachs Asset Management had originally agreed the latter would absorb almost a third of SAMCo’s staff following fiduciary management win

-

Analysis

AnalysisIPE Netherlands Briefing: Dutch funds reverse course on active management

Plus: SamCo, the asset manager of most Shell pension funds, will be wound down, and Goldman Sachs Asset Management will be fiduciary manager of six Shell schemes

-

News

NewsFiduciary fees hold steady amid rising investment costs

Trustees should be alert to further consolidation or poor service as a consequence, warns IC Select’s managing director

-

News

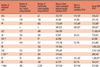

NewsUK fiduciary management AUM hits £272bn as mandate sizes grow

Quantum Advisory’s latest report shows a decline in the number of mandates seeking high returns

-

News

NewsShell pension funds pick GSAM as new fiduciary manager

The decision means that Shell Asset Management Company (SAMCo) will be wound down in due course

-

News

NewsMajority of UK fiduciary managers produced ‘average’ returns over 2024

Fiduciary managers are adjusting tactical equity allocations following the introduction of tariffs

-

Analysis

AnalysisResponsible investment impact of UK pensions reform bill weighed

Industry experts say Pension Schemes Bill misses opportunity to clarify fiduciary duty, and falls short on needed clarity and ambition on sustainable investing