All articles by Gail Moss – Page 3

-

Special Report

Special ReportClass actions: Is Europe catching up with the US?

Europe’s institutional investors are latching on to the rewards of joining class actions against investee companies. Many of these are securities lawsuits, pursued when a publicly listed company has not properly disclosed or has misrepresented significant information, affecting the share price when the truth emerges. But so far, the vast majority of these have been in the US. In 2022, nearly $4.9bn (€4.6bn) was recovered in the US courts, according to Institutional Shareholder Services. So, what about class actions in Europe? “The US has had a class action system for over a hundred years that can be adopted for almost every cause of action, whereas the UK has only had class actions since 2015 and it is only available for competition cases,” says Harry McGowan, partner in the securities litigation department at law firm Stewarts.

-

Analysis

AnalysisIreland’s new sovereign wealth fund

The planned Future Ireland Fund (FIF) aims to cover expected future costs such as pensions and healthcare

-

Country Report

Country ReportSpanish pensions report 2023: funds ride a wave of uncertainty

Diversification remains a key tool in pension fund portfolios

-

News

NewsSpanish pension funds mirror global market surges with 2.3% return to June 2023

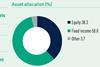

Asset allocation figures show that fixed income still dominates portfolios, although in declining proportions, with an average 55.3% allocation at end-June

-

News

NewsCEO commitment on mental health lacking, CCLA global benchmark shows

There is a clear economic case for investment in mental health at work, says CCLA stewardship lead

-

News

NewsPortuguese pension funds return 1.6% for Q2 2023

Global equities had the highest impact on performance over the quarter, with returns close to 6%, according to WTW

-

News

NewsBelgian pension funds bounce back with 4.5% H1 return

PensioPlus attributed the improved returns to an investment policy focused on long-term investments in the real economy

-

Country Report

Country ReportClouds on the horizon for the fiduciary model in the Netherlands

Demand for fiduciary services has been buoyant but there are few predictions for a healthy future pipeline as the pension transition deadline approaches

-

News

NewsUK buyout market to grow to £60bn per year, say pension professionals

The SPP expects schemes to focus on resilience, against rising interest rates, defaults and longevity

-

News

NewsEuropean trade associations slam active account requirement

Further efforts should focus on streamlining the supervisory framework for EU central counterparties across member states

-

Special Report

Special ReportNorway: Public-sector pensions consultation set for autumn

Occupational pensions could form part of a new review following last year’s Pension Commission report

-

Special Report

Special ReportIceland: Government faces pension fund ire over housing bond controversy

Pension funds have welcomed a relaxation in foreign investment rules but would have preferred a more liberal regime

-

Special Report

Special ReportDenmark: Early retirement rules face further overaul

Arne, a new regime to allow workers in strenuous jobs to retire early may be merged with a more popular scheme

-

Interviews

InterviewsPension funds on the record: The investors developing their own index methodologies

FRR and PUBLICA are among the growing number of European pension funds developing proprietary benchmarks to achieve their sustainability objectives

-

Special Report

Special ReportFrance: Macron’s major pension reforms take effect

September sees the enactment of controversial retirement reforms passed by presidential decree earlier this year, bringing 42 occupational regimes together

-

Country Report

Country ReportNew pension rules set to transform France

After much opposition, profound changes to the retirement system take effect this month

-

Special Report

Special ReportSpain: New regulation introduces lifestyling

Government pushes through legislation package before elections last July

-

Interviews

InterviewsOn the record: Doubling down on debt

Pension funds are focusing on both listed fixed income and private credit

-

News

NewsFrench regulator questions managers’ approach to ESG data providers

Plus: New biodiversity credits initiative between UK and France

-

News

NewsTax transparent fund structure could help UK boutiques grow, says report

IIMI said it is critical that any new rules do not diverge too much from the EU