Investor Strategy – Page 18

-

News

ATP, PFA and PKA inject €475m equity for TDC debt refinancing

Danish pension fund trio add more capital to long-term private equity investment, enabling telecoms giant to refinance €1.44bn of bonds

-

News

Varma unveils biodiversity roadmap, prioritising issue alongside climate

Finland’s biggest pensions insurer follow’s Ilmarinen’s lead, says can’t sit back and wait for Montreal summit results

-

News

AMF buys AP1’s stake in Swedish electricity firm Ellevio

Parties tight-lipped on deal price, but the 12.5% stake was valued at €135m at end of June

-

News

Norway’s new northern fund to be separate from sovereign fund, panel advises

Working titles for proposed investment unit are ‘Government New Northern Fund’ and ‘Government Pension Fund Arctic’

-

News

Storebrand dumps four mining stocks in new nature protection drive

Biodiversity crisis requires collaboration with governments, companies and finance, plus better regulations and reporting, says asset management arm’s CEO

-

Special Report

Special ReportProspects 2023: Asset management roundtable

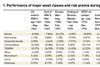

The past year was one of the most challenging ever for institutional investors. Here, asset allocators and others assess the current and future risks to portfolios and identify the opportunities in an environment that remains highly uncertain

-

Special Report

Special ReportProspects 2023: The inflation conundrum facing investors

Institutional investors would do well to include commodities and trend strategies to mitigate inflationary pressures

-

Country Report

Country ReportNordic region: Interview with Richard Gröttheim, AP's outgoing CEO

Richard Gröttheim, AP7’s outgoing CEO tells Pirkko Juntunen about a pension system that many countries are keen to learn from

-

Interviews

InterviewsDelivering pensions ‘like a Bosch’: Bosch pensionsfonds

Dirk Jargstorff (pictured right), CEO of the pioneering Bosch Pensionsfonds, and Christian Zeidler, CFO, talk to Carlo Svaluto Moreolo on the fund’s 20-year anniversary

-

Country Report

Country ReportNordic region: Norway's wealth fund reassesses investment strategy

Review recommends great flexibility for its investment managers

-

News

NewsShift to unit-link pensions threat to Swedish tech start-up success, says AMF

AMF’s CIO responds to McKinsey study warning of the risks associated with occupational pension capital being increasingly driven out of traditional insurance

-

News

NewsChurch of England drafts just transition investment principles

With a pensions fortune of £3.7bn, the Church of England follows up May’s 12-fund pledge to work to support the climate transition in emerging markets.

-

News

Varma diversifies EM bonds away from govvies with $50m in corporates

Finnish pensions heavyweight makes first foray into EM corporate bonds, buying into HSBC AM’s bottom up fixed-income fund

-

News

IPE survey: private equity managers expect stable fundraising, transaction volumes

Given the current valuation levels, 64% of managers said they expected transaction volumes to be stable over the next two years

-

Interviews

InterviewsIrcantec: Aiming for core sustainability

Myriam Métais andCécilia Lyet (pictured) of France’s Caisse des Dépôts talk to Carlo Svaluto Moreolo about managing the reserves of Ircantec, the supplementary scheme for public sector employees

-

News

NewsMSCI sets up client-driven indices to help customise investment strategies

An iCDI solution can serve as an index for an indexed mandate managed by the asset owner internally or by a third-party asset manager

-

News

NewsPrivate equity, mortgages enter net-zero alliance’s protocol in new draft

UN’s investor alliance expands guidance on treatment of sovereign debt in draft of third version of target-setting protocol

-

News

NewsScottish Widows backs BlackRock’s ESG bond fund with £500m

This is the second fund that BlackRock has built in consultation with Scottish Widows

-

News

Border to Coast needs better data to include private assets in climate target

Local government pensions pool publishes roadmap for achieving net-zero emissions by 2050

-

News

AP4 actively seeking companies planning sustainable energy change

Swedish pensions buffer fund explains work with thematic investments focusing on resource-intensive sectors