IPE's United Kingdom Coverage – Page 62

-

News

NewsUK roundup: BA Pensions appoints LCP for actuarial, consulting services

Plus: BlackRock gest FCA green light on long-term asset fund; Broadstone launches specialist admin service; FRC consults on revision to actuarial standards

-

News

NewsPensions regulator calls on DB trustees to brush up on employers’ financial positions

A high level of debt among businesses can risk their ability to support DB pension schemes

-

News

NewsUK travel pension fund secures £900m buy-in deal with Aviva

The buy-in and eventual buyout with Aviva will ultimately result in a better outcome for the vast majority of members

-

Opinion Pieces

Opinion PiecesViewpoint: Differentiation – the future of professional pension trusteeship

When purchasing professional services, choice is good. Differentiated choice is even better.

-

News

NewsAon lauds BoE sparking ‘robust debate’ on wisdom of UK buyout surge

Consultancy responds to warning from UK central bank about risks of insurers rushing to offer bulk annuities to now-healthier DB schemes

-

News

NewsUK bank pension scheme in £1.6bn longevity swap deal

Plus: Repsol Sinopec completes £160m full scheme buy-in with Rothesay

-

Country Report

Country ReportCountry Report – Pensions in UK (May 2023)

UK pensions are at a crucial juncture. The UK Parliament’s inquiry into the LDI crisis of September 2022 shed some light on its causes, but the debate on the role of LDI is alive and well. Meanwhile, regulators including The Pensions Regulator and the Financial Conduct Authority have advised pension schemes on how to make LDI strategies more resilient to shocks.

-

Country Report

Country ReportUK: A review of the LDI debacle

The UK Parliamentary inquiry into the LDI crisis has shed light on its causes, but the debate over the lessons learned for the UK DB industry is far from over

-

Country Report

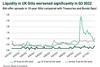

Country ReportUK: to barbell or not to barbell?

In the new world of lower LDI leverage, trustees must choose between maintaining hedging or diversification

-

Country Report

Country ReportUK: Can the country turn a flawed investment ecosytem around?

Decades of complex legislation has fuelled many unanticipated consequences, which has seen pension funds invest less in riskier listed equities and illiquid assets

-

Country Report

Country ReportUK: Beware the unintended consequences of the DB funding code

Laura McLaren highlights the unintended consequences of TPR’s proposed code, and what can be done to mitigate the risks

-

![Ewan McCulloch (7)[33]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/6/1/3/138613_ewanmcculloch733_634858_crop.jpg) Country Report

Country ReportUK: Is it too soon to reform pension pools?

In his March 2023 Budget, UK chancellor Jeremy Hunt challenged the Local Government Pension Schemes (LGPS) in England and Wales to “move further and faster on consolidating assets”, proposing that LGPS funds transfer all listed assets into their pools by March 2025.

-

Country Report

Country ReportUK: The case for pooling

Successful pooled schemes such as Border to Coast should be open to other clients because they are good at what they do

-

Country Report

Country ReportUK: DC investment won't be a panacea for tech and science

The UK government’s March Budget contained plans to boost investment in high-growth industries such as digital, life sciences and advanced manufacturing, so they can start, scale up and remain in the UK.

-

Opinion Pieces

Opinion PiecesBlame will not solve the issues raised by the LDI crisis

The chain of events that led to the UK’s liability-driven investment (LDI) crisis, a high-profile inquiry by the UK Parliament, and a time of anxiety and introspection in the country’s pension industry, started well before then prime minister Liz Truss’s government and its somewhat reckless ‘growth plan’.

-

Country Report

Country ReportUK: Schemes must prioritise members

Pension funds are encouraged to invest in UK illiquids, but it cannot come at any cost

-

Opinion Pieces

CDC: finally off the starting blocks

The Pensions Regulator (TPR) last month approved the Royal Mail Collective Pension Plan as the first registered collective defined contribution (CDC) scheme in the UK

-

Country Report

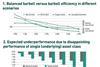

UK: One way for DC schemes to access private markets

There is much debate about mark-to-model valuation methodologies and whether a material economic downturn will cause these to catch up with public market price falls, but the history books will show that portfolios with allocations to private markets were more robust than those with none in 2022 – the worst year on record for traditional balanced portfolios.

-

News

NewsThe Pensions Regulator pushes trustees on long-term funding targets

TPR’s Annual Funding Statement explains how pension funds will need to reset funding and investment strategies

-

News

News‘Potential renaissance’ of UK DB pensions mooted amid parliamentary probe

Work and Pensions Committee’s inquiry into defined benefit pension schemes ends today