IPE's United Kingdom Coverage – Page 77

-

Opinion Pieces

Opinion PiecesViewpoint: Modelling a longevity shock – A £1bn scheme would need to find £120m

By Howard Kearns, longevity pricing director at Insight Investment

-

News

UK pension funds join forces in EM climate transition initiative

The group of pension funds is aiming to be in a position to outline next steps by COP27 in Egypt later this year

-

News

NewsUK’s CEPB drops CA100+ Shell co-lead in engagement focus switch

Pension fund also reports on net-zero progress, highlights limits of single climate measures

-

News

LGPS Central sets up global sustainable fund worth £1bn

The pension schemes for Cheshire, Nottinghamshire, Shropshire and Worcestershire will invest in the equities fund

-

News

NewsNEST picks Schroders for private equity portfolio

The long-term target is to have around 5% of NEST’s portfolio in private equity

-

News

Regs on trustee oversight of consultants, fiduciary managers in ‘late 2022’

CMA ’annual concurrency report’ reveals updated timings

-

News

‘Potentially difficult decisions ahead for DB schemes if inflation stays high’

Most DB pension payment increases in UK are capped at 5%, lower than the current rate of inflation

-

News

NewsBorder to Coast to tender £1bn in EM equity alpha fund

Up to two EM equity managers can be hired to manage around £650m of the fund, joining two China specialist managers already appointed

-

Country Report

Country ReportCountry Report – Pensions in the UK (May 2022)

The 80-plus local government pension funds in England and Wales have been on course to consolidate into eight asset pools for the last six years, with a target of €1-2bn in cost savings by 2033.

-

Country Report

Country ReportUK: Behind the pooling figures for local government pensions

Comparing the cost savings of the eight local government pension scheme pools is a complex exercise

-

Country Report

Country ReportUK: Interview with Sally Bridgeland

Sally Bridgeland, chair of Local Pensions Partnership Investments, discusses the institution’s net-zero carbon emission and cost-reduction strategies

-

Country Report

Country ReportUK: Collective defined contribution pensions move up a gear

The first collective defined contribution pension scheme is set to launch after years of stop-start progress. But obstacles remain

-

Country Report

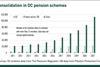

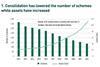

Country ReportUK: The long and winding road to consolidation

Brexit, COVID and other factors delay regulation that would enable commercial DB scheme consolidators to operate

-

Country Report

Country ReportUK: Pension dashboards make slow progress

DWP timeline is met with optimism but complex UK system throws up problems

-

Country Report

Country ReportUK: Auto-enrolment after a decade: broadening the scope

The UK is exploring how to bring younger, part-time, and lower paid workers into the scope of its successful auto-enrolment regime

-

News

Research: UK fiduciary managers relied on strong equities for 2021 returns

More complex strategies not much of a return driver

-

News

NewsTPR calls on trustees to reduce covenant reliance

UK pensions regulator points to the importance of assessing how current market events are shaping the employer covenant

-

News

NewsNEST, CEPB on board as UK transition plan taskforce launches

Taskforce to develop ‘the gold standard’ for climate transition plans as net-zero commitments abound

-

News

NewsUK roundup: Fidelity, Tumelo launch stewardship hub

Plus: Act quickly to lock in funding gains, says Hymans Robertson; LGIM reports on latest DC savers’ preferences

-

News

PPF DB index funding level reaches highest level since June 2007

Increasing bond yields driving up scheme funding levels