Latest analysis – Page 10

-

Analysis

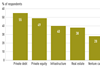

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Opinion Pieces

Opinion PiecesGerman pension reforms in limbo after coalition government collapse

The collapse of Germany’s three-way ‘traffic light’ coalition in November opens questions about the fate of the pension reforms it had drafted over the past couple of years. The government, led by Olaf Scholz, started in 2021 with a mission to reinforce the capital-funded component of the pension system.

-

Opinion Pieces

Opinion PiecesBig Swedish providers raise pension switch worries

Pension transfers are big business in Sweden, and the market could be described as booming right now.

-

Opinion Pieces

Opinion PiecesAustralians seek €3.1bn in lost superannuation contributions

In 2021-22, one in four Australian workers missed out on their superannuation contributions. The total lost was A$5.1bn (€3.1bn), despite the country having a compulsory superannuation system.

-

Opinion Pieces

Opinion PiecesFuture of ESG investing in doubt following decisive Trump victory

In the past two years, an anti-ESG backlash has grown strong roots on the American right.

-

Analysis

AnalysisIPE Netherlands Briefing: First three funds get go-ahead for DC switch

Plus: BP pension fund is considering a buyout to a Dutch insurer for its Belgium-based DB accruals

-

News

NewsWhat the Mansion House speech means for green finance in the UK

Government reinstated the Bank of England’s mandate to support sustainable finance and updated remit letters of key regulators to refer to the need for investment in the green transition

-

Analysis

AnalysisItalian institutional investors confronted with hard reality of net-zero transition

Panellists at Salone.SRI in Milan this week agreed that journey towards net zero will progress despite challenges

-

Analysis

AnalysisIPE DACH Briefing: Germany’s pensions industry looks to new government for reforms

Plus: Transition to DC schemes in Germany; ASIP and Publica in Switzerland warn of consequences of higher lump-sum withdrawals

-

News

NewsConsolidating DC schemes into megafunds could lead to unintended consequences

UK government proposes consolidation of DC schemes into £25bn megafunds

-

Analysis

AnalysisHow German companies deploy AI for occupational pensions

The positive aspect of using AI in occupational pensions is that it helps to transfer information, says Vodafone Pension Trust

-

Analysis

AnalysisIPE ESG Briefing: COP29 dubbed ‘Finance COP’

Plus: Church Commissioners’ message on policies supporting 1.5°C pathway; NZAOA discloses portfolio decarbonisation of 80 asset owners

-

Analysis

AnalysisIPE Nordic Briefing: Iceland preps review of national pensions sytem

Plus: Iceland schemes reject banking rules; Sweden’s watchdog warns of risks for consumers on pension transfers

-

Analysis

AnalysisUK’s productive agenda overlooks life insurers holding £310bn of pension assets

UK life insurers could potentially invest up to £100-£200bn in productive investments over the next 10 years

-

-

Analysis

AnalysisCollapse of German government coalition turns back clock on pension reforms

Finance minister and head of the FDP Christian Lindner, whose party pushed for an equity fund for first pillar pensions, was sacked today

-

Analysis

AnalysisGerman finance minister’s pension plans continue to test coalition

Chancellor Olaf Scholz rushes to hold talks today after FDP finance minister Christian Lindner puts forward new economic reform ideas

-

Analysis

AnalysisWhat happened at COP16?

Major deals were postponed at a UN summit as investors and the private sector busied themselves on the sidelines

-

Analysis

AnalysisThe pensions reform promises of Europe's far-right political parties

The rise of far-right parties has bolstered support for European welfare state systems, but radical right-wing policymakers face difficult choices

-

Opinion Pieces

Opinion PiecesSwiss pension funds reform second-pillar pensions from the bottom up

September’s referendum on the reform of second-pillar pensions demonstrates that comprehensive proposals engineered from the top down don’t always bring the expected results. The latest proposal was roundly defeated by two thirds of the electorate.