Latest Asset Class Reports -3 – Page 8

-

![Kato Mukuru photo (2)[1]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/8/6/6/117866_katomukuruphoto21_973480_crop.jpg) Asset Class Reports

Asset Class ReportsCreating impact in Africa

Companies in Africa traditionally look to private equity to raise capital, providing vast opportunities to PE investors

-

Asset Class Reports

Asset Class ReportsEmerging market debt report

Our opening article in this report looks at emerging market private credit. In EMs there is a $100bn corporate funding gap with 90% of lending through banks. But we find EMD managers broadly cautious overall, particularly on China, with interviews conducted before the Evergrande story broke. Lastly, we look at Latin America, where investors encounter populism and social unrest but sustainability bond issuance is booming.

-

Asset Class Reports

Asset Class ReportsThe next frontier for private credit

Global managers are making a strong case for investment in private credit issued by emerging market companies

-

Asset Class Reports

Asset Class ReportsAsset Allocation: Mixed prospects emerging

COVID and political risks may have affected EMs in different ways but there are still many opportunities in such a diverse asset class

-

Asset Class Reports

Asset Class ReportsEmerging Market Debt: Populism battles ESG in Latin America

Many policies championed by populist leaders in Latin America are in direct conflict with the ESG goals of global investors

-

Asset Class Reports

Asset Class ReportsAsset class report – Equities

The number of listed companies in the US and the UK has fallen dramatically over the past quarter century, putting more pressure on institutional investors to invest in private equity, as we cover in this report. The report also looks at the emerging market small-cap sector and UK’s micro caps.

-

Asset Class Reports

Asset Class ReportsInflation report – Pension funds riding the wave

As the outlook for inflation becomes increasingly cloudy, European institutional investors try to focus on long-term trends

-

Asset Class Reports

Asset Class ReportsPE is back in the running

The case for more investing in private equity is becoming compelling as the number of listed companies declines

-

Asset Class Reports

Asset Class ReportsOutlook: Inflation naysayers versus the Comeback Kid

The effect that even moderate levels of inflation can have on investments means its possibility should not be treated lightly

-

Asset Class Reports

Asset Class ReportsUK Micro Caps: Below the line of abandonment

Kestrel Partners exploits a structural inefficiency in the UK’s micro-cap market

-

Asset Class Reports

Asset Class ReportsSmall caps: There for the taking

Incorporating the wide range of data available today into investment processes can open up a wealth of new opportunities

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Credit report

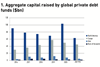

As the institutional investment community heads towards a post-COVID new normal, private credit remains a favourite among investors despite inflationary headwinds. In this report, we also cover the record amounts of capital raised by private-debt funds last year, the latest developments ESG in private markets, and how the digital transformation accelerated by COVID is impacting private debt.

-

Asset Class Reports

Asset Class ReportsActivist investors: Muscular stewardship

New types of activist investor are attracting support from long-term asset owners, particularly on environmental and social topics

-

Asset Class Reports

Asset Class ReportsUS Equities: Challenges for US active managers

Active managers are grappling with several key themes as they deal with a concentrated market until recently buoyed by stimulus

-

Asset Class Reports

Asset Class ReportsAsset class report – Emerging market equities

The pandemic has substantially altered the landscape for emerging markets. While some countries have contained its effect better than any developed market, others have been devastated. How should investors regard the impact of COVID-19 in their decision-making on future increases on allocations to emerging markets? In this report, we analyse the outlook for the asset class in general, and find out why Brazil continues to hold the interest of investors.

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Factor investing report

COVID-19 has added a further blow to a decade of factor investing underperformance and highlighted the increasing impact of environmental, social and governance (ESG) considerations. In this report, we analyse how it may be possible to complement traditional factors with ESG-related measures.

-

Asset Class Reports

Asset Class ReportsAsset allocation: More factors to consider

COVID-19 has added a further blow to a decade of factor investing underperformance and highlighted the increasing impact of ESG

-

Asset Class Reports

Asset Class ReportsEM outlook: Opportunities amid uncertainties

The pandemic has greatly affected emerging markets but while some are in a bad state others are showing great resilience

-

Asset Class Reports

Asset Class ReportsESG: Avoid sustainable equity exposure pitfalls

ESG strategies can introduce unintended factor biases, which can affect overall risk-return objectives if not managed correctly

-

Asset Class Reports

Asset Class ReportsEM equity outlook resilient despite gloom

There is less difference between apparently conflicting expert views on the prospects for emerging markets than first appears