Latest from IPE Magazine – Page 22

-

Special Report

Special ReportItaly: Policymakers focus on first pillar

Despite recent growth, second-pillar pensions have never been a priority for the Italian government

-

Special Report

Special ReportNetherlands: First funds prepare for DC switch

Despite pre-election threats, the transition is not expected to be rolled back by the new government

-

Special Report

Special ReportNorway: New buffer fund rules to boost returns

Providers of private guaranteed pension products are now allowed to take more risk in an effort to improve performancean

-

Special Report

Special ReportPortugal: Sticking to the pension promise

The country’s new government has vowed to increase retirement payments

-

Special Report

Special ReportSpain: Sweeping pension reforms fail to get off the ground

The country’s unstable political environment means pensions are not a priority

-

Special Report

Special ReportSweden: Alecta continues to hit the headlines

Swedish policymakers are kept busy as the prospect of a merger of the AP funds is again under the spotlight

-

Special Report

Special ReportSwitzerland: Workplace pension reform faces referendum test

The country is introducing regulations on greenwashing and fund investments, while debating how to fund the first and second-pillar pension systems

-

Special Report

Special ReportUK: Labour government seeks continuity with focus on boosting domestic investment

The Department for Work and Pensions will have its work cut out as the new Labour government starts a comprehensive pensions review

-

Country Report

Country ReportItaly Country Report 2024: How local pensions could support the economy

The Italian pension industry and policymakers are discussing ways to channel more pension investment towards the country’s business sector

-

Asset Class Reports

Asset Class ReportsPrivate credit: How banks are joining forces with managers

As the private credit market grows, banks are looking to partner with private credit managers rather than compete with them

-

Asset Class Reports

Asset Class ReportsMulti-asset private credit comes to the fore

Investors are increasingly looking at multi-asset private credit mandates for diversification and stable risk-adjusted returns

-

Country Report

Country ReportItalian pension funds fine-tune asset allocation

Growing appetite for private market investments, amid shifting equity and bond portfolios, are keeping Italian pension funds busy

-

Asset Class Reports

Asset Class ReportsCompenswiss: a newcomer to private credit

Four European pension schemes outline their activity in the private credit market

-

Country Report

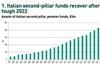

Country ReportSlow growth for Italy's second-pillar pensions

Despite the urgency of increasing second-pillar coverage, policymakers continue to focus reform efforts on public pensions

-

Country Report

Country ReportCDC pension fund benefits from a steady stream of young members

The Cassa Dottori Commercialisti (CDC) is one of the most sustainable casse di previdenza, the Italian privatised first-pillar funds for professionals, thanks to prudent asset allocation and the CDC’s policy to attract young Italians to the chartered accountancy profession.

-

Asset Class Reports

Asset Class ReportsDenmark’s Lærernes ups its appetite for private credit risk

Lærernes Pension (LP), the pension fund for teachers in Denmark, started investing in private credit in 2018, in small amounts. In 2021 it made a more sizeable strategic allocation to the asset class.

-

Asset Class Reports

Asset Class ReportsRegulators shine a light on non-bank lenders

Although private market activity is slowing down, there are fears of systemic risk

-

Asset Class Reports

Asset Class ReportsPublic-to-private borrowing is a two-way street

The private credit boom seems to be drawing to a halt as public funding becomes cheaper

-

Country Report

Country ReportENPAM looks to preserve cash flow

In February 2024, the board of ENPAM, the first-pillar pension fund for doctors and dentists, approved plans for the fund to transition to an asset liability management (ALM) model that will focus on liability-driven investment (LDI).

-

Asset Class Reports

Asset Class ReportsNEST’s outsourcing strategy

When NEST was weighing up whether to outsource some of its private markets allocations, the decision was not straightforward.