Latest Special Reports – Page 13

-

Special Report

Special ReportNatural capital: KLP hopes for a nature-positive economy

The asset manager’s head of responsible investments speaks to Sophie Robinson-Tillett about her optimism that the COP15 agreement will lead to regulatory change

-

Special Report

Special ReportNatural capital: New nature fund aims to halt loss of flora and fauna

Global Biodiversity Framework fund is targeting $200bn per year by 2030, but there is uncertainty about private sector participation

-

Special Report

Natural capital: First nature benchmark shows the time to act is now

Investors can contribute to a nature-positive world now by understanding their portfolio company impacts on nature and prioritising action

-

Special Report

Special ReportUK pension risk transfer market set for bumper 2023

Improved pricing and funding levels turned 2022 into a busy year for insurers, with more demand expected in 2023. But can they cope with the higher demand and will pricing remain competitive?

-

Special Report

Special ReportPension funds on the record: The benefits of a themed portfolio

European pension funds are increasingly organising portfolios according to ‘themes’. Here are two examples of thematic investing in equities

-

Special Report

Special ReportSpecial Report – DC pensions

Workplace pensions can differentiate themselves by their stewardship and engagement programmes. But effective stewardship is generally the preserve of larger defined benefit players and big investment managers. Now, technology means investors in smaller pooled funds can express their proxy voting preferences, shifting the power away from the managers and towards asset owners.

-

Special Report

Special ReportDC Pensions: Funds take greater role in corporate stewardship

Voting power is still largely with fund managers, but DC schemes are taking steps to make their voice heard

-

Special Report

Special ReportDC Pensions: UK funds grapple with cost of living crisis

Auto-enrolment in the UK has been a success, but the many strains on household incomes represent its biggest test yet

-

Special Report

Special ReportDC Pensions: Australians exercise pension choice

While the default MySuper dominates the superannuation industry, Australia’s defined contribution system offers a complex and wide range of options for retirement

-

Special Report

Special ReportDC Pensions: Dutch pension funds grapple with member choice decisions

Member choice will be central after Dutch pension reform, at least in theory

-

Special Report

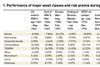

Special ReportSpecial Report – Prospects 2023

The past year will be remembered as one of the most challenging for institutional investors ever. The outlook for 2023 is brighter, if anything because valuations of major asset classes have come back to historical levels.

-

Special Report

Special ReportProspects 2023: Asset management roundtable

The past year was one of the most challenging ever for institutional investors. Here, asset allocators and others assess the current and future risks to portfolios and identify the opportunities in an environment that remains highly uncertain

-

Special Report

Special ReportProspects 2023: The inflation conundrum facing investors

Institutional investors would do well to include commodities and trend strategies to mitigate inflationary pressures

-

Special Report

Special ReportProspects 2023: How important are the carbon markets?

Carbon pricing is key to investment in green technology

-

Special Report

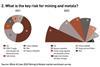

Special ReportProspects 2023: ESG-driven divestments threaten energy transition

Investor support for miners is crucial to ensure a sufficient supply of metals for renewable technology

-

Special Report

Special ReportProspects 2023: Does zero China make sense?

Many investors are avoiding the People’s Republic, but they would do well to look at the reality

-

Special Report

Special ReportESG: Joined up thinking required

At last year’s Conference of the Parties, COP26, the financial sector stole the show.

-

Special Report

Special ReportSpecial Report – ESG

Our report looks at the ESG through the prism of private markets, with coverage of SFDR and an interview with Anner Follèr, head of sustainability at Sweden’s national private equity investor AP6

-

Special Report

Special ReportESG: Dirty asset divestment

There is growing focus on public companies that are under pressure to sell high-carbon assets to unlisted companies or private equity

-

Special Report

Special ReportESG: Prepping the next generation of listed companies on ESG

Investors are helping private companies understand their expectations before they go public