All Letter from Australia articles – Page 3

-

Opinion Pieces

Opinion PiecesLetter from Australia: Public places, private matters

AustralianSuper marked a milestone with its successful takeover in 2019 of education provider, Navitas, for A$2.1bn (€1.3bn).

-

Opinion Pieces

Opinion PiecesLetter from Australia: Too good to be true?

If Australia’s latest five-yearly Intergenerational Report (IGR) is to be taken seriously, Australian retirees can look forward to comfortable retirements 40 years hence.

-

Opinion Pieces

Opinion PiecesLetter from Australia: When the ‘kill switch’ misfires

The Australian government is attempting to push through Parliament legislation that would selectively benchmark the performance of superannuation funds – but has given up its intention to override investment decisions made by super funds.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Coalition mulls super hike

There are arguments both for and against a rise in compulsory superannuation contribution rate as Australia emerges from the COVID-19 pandemic .

-

Opinion Pieces

Opinion PiecesLetter from Australia: A question of gender imbalance

Statistics offer a snapshot into the real world and they reveal a depressing picture of gender inequality in Australia’s superannuation system.

-

Opinion Pieces

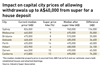

Opinion PiecesLetter from Australia: Should super savings fund homes?

A post-COVID-19 housing boom has made the future of Australia’s A$3trn (€2trn) superannuation savings pool a hot topic.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Retail super funds in distress

Australia’s once-dominant retail super funds are witnessing the end of an era as they wrestle with loss of consumer confidence in their brands. Hastening change has been the rise of industry supers, which benefitted from damaging evidence provided to the Hayne Royal Commission in 2018.

-

Opinion Pieces

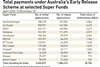

Opinion PiecesLetter from Australia: Early access genie escapes the bottle

In March 2020, as the Australian economy went into COVID-19 lockdown the government unlocked the national superannuation pool, seeking to ease the financial stress on individuals.

-

Opinion Pieces

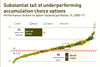

Opinion PiecesLetter from Australia: Reforms not super for default funds

A string of government reforms due to come into effect from July 2021 has caught the superannuation sector off-guard.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Funding the future world

A handful of Australian superannuation funds are committing their members’ savings to the future world in terms of energy, water, technology and ideas. There will be successes and failures as ideas are developed and marketed.

-

Opinion Pieces

Opinion PiecesLetter from Australia: ESG stirs some ancient ghosts

In May this year, Rio Tinto blew up one of Western Australia’s most significant Aboriginal heritage sites.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Pooling for savings and strength

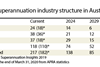

The government, the regulator and economic fallout from COVID-19 have combined to pressure Australia’s large and unwieldy pool of super funds towards consolidation.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Paltry pickings in the political pie

As deficits mount in a post-COVID-19 world, politicians and bureaucrats are again eyeing national pension savings – hundreds of billions of dollars they can capture at the stroke of a legislative pen.

- Previous Page

- Page1

- Page2

- Page3

- Next Page