Swiss stock exchange SIX has launched a trading platform for digital assets – SIX Digital Exchange.

SIX Group, the owner of the stock exchange, has placed the first senior unsecured digital bond with a total volume of CHF150m (€143m) and matring in 2026. The digital bond carries a coupon of 0.125% per year.

The bond is split into a digital segment with a total issuing volume of CHF100m traded on SDX Trading and centrally held by SIX Digital Exchange, and a traditional segment with a volume of CHF50m trading on SIX Swiss Exchange, centrally held by SIX SIS, the Central Securities Depository (CSD) providing custody services.

Credit Suisse, UBS Investment Bank, and Zürcher Kantonalbank acted as the joint lead managers on the deal.

According to SIX, the bond offering was several times oversubscribed attracting “strong interest” from institutional investors, it said.

SIX Digital Exchange received the approval to operate as a stock exchange and central security depository for digital assets from the financial supervisory authority FINMA in September.

Thomas Zeeb, global head exchanges at SIX, said: “The first issue of a tokenised bond on the SIX Digital Exchange, its listing and placement in the market proves that the forward-looking distributed ledger technology (DLT) also works very well in the highly regulated capital market.”

Swiss govt steps up against greenwashing

The Swiss government has recommend the financial industry to use “meaningful climate-compatibility indicators” to improve transparency for all financial products and customers’ portfolios to avoid the risks of greenwashing.

One of the methods to improve transparency is, for example, using key data on temperature. This means that the production plans of companies in investment portfolios are compared against the necessary measures to take to limit global warming to a maximum 1.5°C.

The data help clients classify financial products in terms of their climate impact, the government said, encouraging the financial industry to join international “net-zero alliances”.

The government has also asked the Federal Department of Finance (FDF), in collaboration with the Federal Department of Environment, Transport, Energy and Communications (DETEC), to communicate by the end of 2022 on the progress made by the financial industry to put in place the recommendations.

The cabinet has also commissioned the FDF, in cooperation with DETEC and the supervisory authority FINMA, to propose amendments to the financial market law by the end of 2022 to avoid greenwashing.

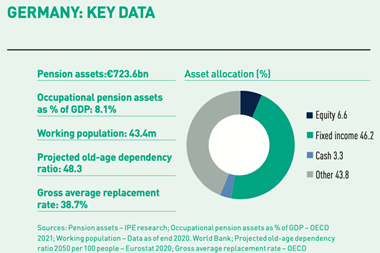

BaFin’s goals and stats

The German financial supervisory authority BaFin has set goals for the period 2022-2025, taking into account sustainability in supervisory activities, focusing on the analysis and mitigation of the financial risks for the supervised companies and compliance with disclosure requirements, and greenwashing risks.

BaFin will work to make sure that companies and the financial system are resistant to pressure in terms of capital and liquidity, in particular looking at interest rate and market scenarios, and examining at the same time possible new business models in light of digitisation.

It will also look at cyber security risks, the governance of firms, money laundering prevention, and how to implement an effective control on balance sheets.

The supervisory authority has also published statistics on Pensionskassen and Pensionsfonds for 2020. The number of Pensionskassen under supervision remained unchanged year-on-year in 2022 at 135, with total assets of €190bn, up from €183bn in 2019.

Capital for investees stood ta €184.5bn at the end of last year, an increase from €176.9bn the prior year.

The 34 Pensionsfonds under BaFin’s supervision in 2020 had total assets of €55.34bn and capital for investments of €3.47bn.

German actuaries’ mixed comments on Solvency II

The German Association of Actuaries (DAV) has weighed in on the EU Commission’s proposal to review the Solvency II Directive.

Maximilian Happacher, deputy chair of DAV, said the Commision’s proposal has “significant improvements” compared with the original idea by the European Insurance and Occupational Pension Authority (EIOPA), particularly with regards to interest rate risk.

The actuaries consider positive the fact that in future interest rate risks are measured on actual capital market developments, and that transitional period to the new regime lasts until 2032.

DAV believes that there is still need for improvement with regards to the so-called extrapolation method for the yield curve.