The number of members in pension schemes in Italy has increased by 3% in the third quarter of 2023, compared with the end of 2022, to reach 9.51 million, according to the latest figures published by pension regulator Covip.

Second pillar pension system contracts amount to a total of 10.6 million if counting employees that have signed up for multiple forms of occupational pension arrangements.

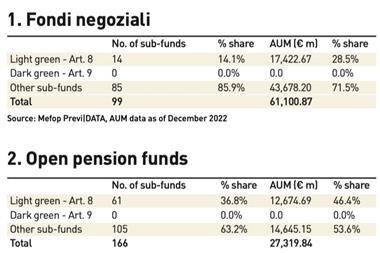

Industry-wide pension funds (Fondi Negoziali) added 188,000 members so far this year, compared with the end of 2022, a 4.9% increase, for a total of almost 4 million members.

The highest increases in terms of memberships were recorded in the construction sector (86,700), with contributions of a modest amount paid by the employer based on a contractual agreement, and in the public sector (28,900), where members have joined the pension schemes based on the silent consent mechanism for new hires.

The severance pay (Trattamento di Fine Rapport, TFR) flows directly to a pension fund, based on the collective bargaining agreement, if the new hires don’t decide whether to allocate it to second pillar schemes, or to keep it in the company – the so-called ‘silent consent’.

The reasons for the positive development in the number of members are the increase in employment, the ‘silent consent’ rule, a greater awareness by employees that a second pillar pension system, beyond first pillar Istituto Nazionale di Previdenza Sociale (INPS), is important, and the returns of pension funds in the long-term that are higher than those recorded by INPS, a Covip spokesperson told IPE.

“The latest data [published] by Covip highlight a growth in membership. It is certainly not a surprise and is in line with previous years. More and more citizens know and appreciate the advantages of pension funds and join them with trust,” Paolo Pellegrini, deputy director of Mefop, the organisation for the development of the pension fund market, told IPE.

Pellegrini also noted that there has been a recovery in terms of returns for second pillar schemes in Italy, after a challenging 2022. Industry-wide pension funds returned 2.2% in the first three months of this year, from -9.8% recorded at the end of 2022.

Open pension funds (fondi pensione aperti) recorded a 3% return, compared with -10.7% at the end of last year, and private pension plans (PIP nuovi) returned 3.6% so far this year, compared to -11.5% in 2022, according to Covip.

The regulator underlined that, in the first third quarter of this year, equity sub-funds of industry-wide pension schemes returned on average 4.5%, 5.5% in open pension funds and 6% in PIPs.

The Bilanciato sub-funds returned on average 2.1% in industry-wide pension schemes, 2.2% in PIPs and 3% in open pension funds, while returns of bonds and Garantito sub-funds stood on average at 1-2%, it added.

Assets under management grew at the end of September to €215bn, from €205bn at the end of December last year, pushed up mostly by better priced securities in portfolios, Covip said.

The amount of contributions also increased in second pillar schemes by 6% at the end of Q3 this year, compared with the end of last year, to €9.8bn, it added.

The latest digital edition of IPE’s magazine is now available