Higher interest rates will halt the strong growth of private markets seen over the last few years, but this is no bad thing as it will eliminate weaker performers, according to the chief executive officer of the State Pension Fund of Finland (Valtion Eläkerahasto, VER).

Timo Löyttyniemi, CEO of the €22.8bn buffer fund for Finnish central government staff pension expenditure, wrote in a new blog that private markets had been growing at a brisk pace.

“While this is expected to continue over the coming years, the current interest rates will bring the growth to a temporary halt,” he said in the article published on Thursday.

“A pause is welcome as it will push weaker performers out of the race,” the CEO said.

Successful players would continue to grow if investment returns supported growth, he said, but warned: “The sector will come under real fire when returns fail to compensate for the high costs”.

But despite this, Löyttyniemi said, pointing to the advantages for investors of private assets: “this illiquid market will continue to enjoy the advantage of lower volatility in value compared to the public markets”.

“Cost structures are still prohibitively high, but as healthy returns have outweighed higher costs, there is little pressure to change things”

Timo Löyttyniemi, CEO of Finland’s VER

Commenting on the effect that rising interest rates were having on private markets, he said future returns on illiquid private investments would be determined by movements in interest rates.

“Each new day of high interest rates aggravates the situation,” he said.

Real estate and venture capital investments lay at one extreme, he said, with the interest rates being the key discount factor for these assets

“At least for the time being, infrastructure and private credit investments have been spared from inflation and rising interest rates,” he said, adding that this was because income flows here were tied to inflation, or the loans carried a variable rate of interest.

Löyttyniemi said an eternal problem affecting private markets was individual treatment in terms of law and taxation, with the lack of standardisation for these products meaning each investor had to assess the investments from a technical and legal point of view.

“In addition, cost structures are still prohibitively high, but as healthy returns have outweighed higher costs, there is little pressure to change things,” he said.

“What is also new is that much of the private market activity is already attracting the attention of the authorities supervising financial markets,” the VER CEO said.

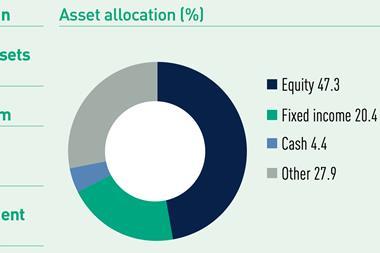

Last month, VER said it had reached its target allocation for private assets after years of building the portfolio, and did not expect to increase that goal.

Read the digital edition of IPE’s latest magazine