The State Pension Fund of Finland (Valtion Eläkerahasto, VER) – the Finnish buffer fund for the central government staff pension scheme – has reached its target allocation for private assets after years of building the portfolio, and does not expect to increase that goal.

The Helsinki-based fund saw an increase in the market value of its assets to €22.8bn by the end of 2023, up from €21.6bn at the end of 2022, after returning 7.7% on investments during the year, which amounted to 4.0% in real terms, according to VER’s annual report released on Friday.

Within the overall return, the main asset classes of liquid fixed income and listed equity instruments generated 6.9% and11.3%, respectively.

Among other asset classes, VER said the best performance had come from private credit funds at 8.5% and the category of “other fixed income investments” with a 7.9% gain.

VER is currently in a phase of change, with its net contributions to the government budget set to increase in the future as a result of the amendment to the Act on the State Pension Fund and rising pension expenditure.

Timo Löyttyniemi, VER’s chief executive officer, said the net transfer to the government budget was now 2% of the fund’s assets, but was expected to increase to between 4% and 5% in the coming years.

“These factors will limit the fund’s growth in the future and create new investment challenges,” he said.

In 2023, VER received €1.7bn in pension contribution income and transferred some €2.1bn to the government budget.

Löyttyniemi told IPE that VER was currently working on the exact impact of this new phase, in which the buffer fund will have a more negative outflow profile than other Finnish pension funds.

“Investment strategy will be path dependent,” he said, adding that investment returns achieved may impact the investment strategy.

“However, it would not be very likely that we would increase the equity allocation in the portfolio as it would increase the volatility too much,” said the CEO.

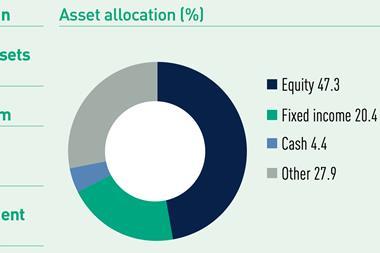

Right now, VER is targeting a 20-25 % range for private assets, and the 2023 figures show this allocation stood at around 23% at the end of last year – little changed from a year before.

“Most likely, that target will not be increased,” Löyttyniemi said.

“Even to keep that level requires new commitments in the region of €500m per year,” he said.

Read the digital edition of IPE’s latest magazine