Pensions in United Kingdom Report – Page 2

-

Country Report

Country ReportUK: Schemes must prioritise members

Pension funds are encouraged to invest in UK illiquids, but it cannot come at any cost

-

![Ewan McCulloch (7)[33]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/6/1/3/138613_ewanmcculloch733_634858_crop.jpg) Country Report

Country ReportUK: Is it too soon to reform pension pools?

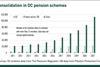

In his March 2023 Budget, UK chancellor Jeremy Hunt challenged the Local Government Pension Schemes (LGPS) in England and Wales to “move further and faster on consolidating assets”, proposing that LGPS funds transfer all listed assets into their pools by March 2025.

-

Country Report

Country ReportCountry Report – Pensions in the UK (May 2022)

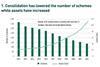

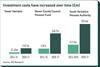

The 80-plus local government pension funds in England and Wales have been on course to consolidate into eight asset pools for the last six years, with a target of €1-2bn in cost savings by 2033.

-

Country Report

Country ReportUK: Auto-enrolment after a decade: broadening the scope

The UK is exploring how to bring younger, part-time, and lower paid workers into the scope of its successful auto-enrolment regime

-

Country Report

Country ReportUK: Behind the pooling figures for local government pensions

Comparing the cost savings of the eight local government pension scheme pools is a complex exercise

-

Country Report

Country ReportUK: Interview with Sally Bridgeland

Sally Bridgeland, chair of Local Pensions Partnership Investments, discusses the institution’s net-zero carbon emission and cost-reduction strategies

-

Country Report

Country ReportUK: Collective defined contribution pensions move up a gear

The first collective defined contribution pension scheme is set to launch after years of stop-start progress. But obstacles remain

-

Country Report

Country ReportUK: The long and winding road to consolidation

Brexit, COVID and other factors delay regulation that would enable commercial DB scheme consolidators to operate

-

Country Report

Country ReportUK: Pension dashboards make slow progress

DWP timeline is met with optimism but complex UK system throws up problems

-

Country Report

Country ReportCountry Report – Pensions in UK (May 2021)

The UK’s Pension Schemes Act was finally signed in February 2021, after nearly two years of negotiations in parliament that were severely disrupted by elections, Brexit-related negotiations and the COVID-19 pandemic. The new rules have given the Pensions Regulator (TPR) new powers that could see it intervene in corporate actions such as mergers and acquisitions, as we analyse in this report. The report also looks at other key topics impacting the UK pensions sector, including DB funding, climate change, risk management and pension dashboards.

-

Country Report

Country ReportClimate risk: Climate of change

Pension schemes will have to adjust their systems to cope with new regulations to tackle climate change

-

Country Report

Country ReportPension dashboards – a need for clarity

Dashboards hold out the promise of allowing individuals to see all their retirement savings on one digital platform

-

Country Report

Country ReportFunding code: Deciphering the new code

With the Pensions Regulator consulting on a new code of practice for defined benefit (DB) scheme funding, trustees are advised to take a long-term view of investment, covenant and liabilities

-

Country Report

Country ReportCommentary: A complex journey to net zero

Tackling climate change successfully is not just a matter of following rules. It is a continuum that trustees must embrace

-

Country Report

Country ReportDB funding – a mixed recovery story

Last year brought both operational and financial challenges for defined benefit schemes but some have come out looking better for it

-

Country Report

Country ReportM&A: Regulator set to scrutinise more deals

New tools granted to the Pensions Regulator could see it play a more prominent role in corporate activity such as mergers and acquisitions (M&A)

-

Country Report

Country ReportRisk Management: LDI strategy at a time of pandemic

Wild swings in UK bond yields caused by COVID have triggered a surge in hedging activity

-

Country Report

Country ReportUK country report: Valuations: Rising to the challenge

The pandemic has brought testing times for the valuations and operation of DB schemes

-

Country Report

Country ReportUK country report: Regulator plans twin-track funding code

Consultation continues to prepare DB schemes to be less reliant on sponsors as the sector matures

-

Country Report

Country ReportUK country report: Moving towards an ESG crescendo

Trustees should use the COVID-19 lockdown as a time to prepare for the next round of ESG reporting requirements in October