White papers

White papersFX Futures: Why They Matter in Currency Overlay Management

A discussion with 7orca, the Germany-based specialist asset manager, and CME Group

- Services

CME Group's Services

CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate.

- Save articleNews

McGraw-Hill, CME Group launch S&P Dow Jones Indices

New joint venture to become world’s largest provider of financial market indices.

White papers

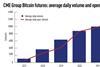

White papersCan CME Bitcoin Futures Be Used Effectively by Crypto-Fund Managers?

See how investors can use CME Bitcoin futures to establish benchmark equity index exposure and develop alpha-generating strategies.

White papers

White papersWebinar – Nowcasting the US Economy

Join CME Group Chief Economist, Blu Putnam, as he shares insights using alternative data and nowcasting to monitor developments in the US economy.

White papers

White papersReplicating OTC FX Market Positions with CME FX Futures

Explore the advantages that CME FX futures offer traditional market practitioners in the OTC FX markets, and how CME FX futures can be used to replicate cost-efficient, manageable synthetic exposure to OTC FX spot, forwards, and swaps.

- White papers

Navigating Uncleared Margin Rules

CME Group offers bilateral and cleared solutions to help you comply with UMR, minimize impacts to your firm and add capital efficiencies.

White papers

White papersSpecific and accurate physical commodities price calculation via Cloud Distribution Solutions

How Grão Direto, a Brazilian startup, built a tool that calculates customized grain prices for sellers, warehouses and properties, using CME Smart Stream on Google Cloud Platform solution.

White papers

White papersNASDAQ 100-S&P 500 Volatility Ratio at Peak Levels

The cost of NASDAQ 100 options has ballooned relative to S&P 500 options over the past three years as the tech-heavy index leads the recovery in equities. Read the latest article from CME Group Senior Economist, Erik Norland.

- Save article

Special Report

Special ReportCrypto ETFs: exploring the keys to mass adoption

The ProShares Bitcoin Strategy ETF (BITO) made history last October as one of the strongest ever ETF launches, amassing more than $1bn (€1bn) in assets in just two days.

White papers

White papersCase Study: Avoiding cash drag using Equity Index futures

Cash is a necessary component of most investment portfolios. It’s present in a portfolio for operational reasons, including managing subscription/redemption flows and income streams such as dividends.

White papers

White papersQ&A With ARRC’s Tom Wipf: The Shift to Term SOFR

CME Group’s Secured Overnight Financing Rate (SOFR) Term Rates have seen extensive client interest since the Alternative Reference Rates Committee (ARRC) endorsed them on July 29, with the move marking the last step in the ARRC’s Paced Transition Plan from LIBOR.

White papers

White papersUMR Phase 5: A Real Challenge for Real Money?

In this article, we discuss the challenges along with the potential impacts and responses of the Uncleared Margin Rules (UMR) on real money accounts.

White papers

White papersTraiana on the buy-side’s increasing adoption of post-trade technology

Head of Product Strategy for CME Group’s Traiana, Steve French, talks to HFM Asia editor Tom Duffell about the buy-side and post-trade technology.

White papers

White papersWhitepaper: A Great Time to Be Agnostic?

CME Group recently collaborated with Pensions & Investments (P&I) to survey the attitudes and allocation preferences of today’s institutional investors, given the current market environment and the use of alternative investment strategies.

White papers

White papersThe Ever-Shifting Shanghai Gold Market Landscape

As the world’s largest gold producer, China plays an outsized role in global gold markets. But in order to fully satisfy domestic demand for jewelry and other forms of gold, the country also typically relies on imports.

White papers

White papersCase study: Helping a bank publicly report on its sustainable hedging activities

Banks increasingly have a mandate set out by their leadership to prioritize “Sustainable Hedging;” that is, derivatives trading that supports the financing of sustainable business projects. Some even have specific lines of credit set aside for this type of trading activity.

White papers

White papersCase study: Trade the When Issued (WI) security a month in advance using Micro Treasury Yield futures

Learn how investors can use smaller-sized, yield-based Treasury futures contracts to roll when-issue in advance, less expensively than previously possible.

White papers

White papersCase study: Maintain a fund’s mandated asset allocation ratio through shifting markets

A portfolio manager with a $2 billion portfolio has a mandate to maintain a 60/40 mix (60% equities to 40% fixed income). Within the 60% equities allocation ($1.2 billion), the manager must maintain a 50/50 mix of large-cap equities benchmarked to the S&P 500 and small-cap equities benchmarked to the Russell 2000.