All Special Report articles – Page 56

-

Special Report

Crowding concerns

The rise in popularity of factor investing strategies and products raises questions about crowding, writes Paul Amery

-

Special Report

Global Defined Contribution: Targeting the right glidepath

Christopher O’Dea finds defined contribution pension sponsors are increasingly looking for more flexibility in target-date funds to cope with changing worker demographics

-

Special Report

Gaining currency as a risk control

Lynn Strongin Dodds finds that worries about currency risk are leading investors to consider factor-based approach when investing in foreign exchange markets

-

Special Report

The great factor debate

Daniel Ben-Ami examines a key question that is too often neglected: why does factor investing work?

-

Special Report

Full of EM promise

David Turner finds elements of factor investing that could make the strategy ideal for emerging markets

-

Special Report

Listed Equity: The five tests of impact

Andrew Parry argues that five key tests should be applied to public market investments before they can be termed impact investments

-

Special Report

Listed Equity: A public role

New indices and ETFs apply impact investment to liquid equities. But corporate reporting and investor focus are central, according to Liam Kennedy

-

Special Report

Special ReportSpecial Report Factor Investing: Meeting expectations

It is important to have realistic expectations about what factor investment can deliver

-

Special Report

A risk-reducing factor

Many factor investors use timing as a way to reduce risks, writes David Turner

-

Special Report

McKnight Foundation: Sticking to impact

Christopher O’Dea speaks to the McKnight Foundation of Minnesota about its $200m commitment to impact investment strategies

-

Special Report

A new frontier?

Everyone seems to want to talk about investing for impact these days. But a lack of a common understanding can make this difficult, according to Susanna Rust

-

Special Report

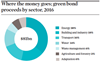

Special ReportGreen growth

High levels of green bond issuance have sparked investor interest and spawned funds and strategies, writes Rachel Fixsen

-

Special Report

Special ReportSpecial Report: Investing for Impact

Although relatively new, impact investing is still the term that has been around the longest to describe investing with the explicit purpose of achieving positive non-financial impacts in addition to financial gain

-

Special Report

Special ReportImpact Investing Market Statistics: Trends and snapshots

Data collected from 62 investors that completed the GIIN’s annual impact investor survey in each of the years 2014-2016, covering 2013-2015

-

Special Report

PGGM: Impactful solutions

PGGM’s involvement in impact investing predates the UN Sustainable Development Goals, finds Rachel Fixsen

-

Special Report

IPE at 20: Insights from 100 conversations

While researching his book on the future of pension management, Keith Ambachtsheer spoke to some 100 pension funds from all around the world. He shares insights from those conversations

-

Special Report

Special ReportIPE at 20: Back to 1996 - four moments in pension investing

Fads and fashions ebb and flow, in the world of pension investment seemingly as much as any other. Balanced management is firmly out of favour. Fiduciary management is in. Yet both represent a different take on the outsourcing of investment

-

Special Report

IPE at 20: Time for retirement ‘SeLFIES’?

The potential global retirement crisis needs to be addressed by timely innovation. The longer governments wait, the higher the cost, argue Robert Merton and Arun Muralidhar

-

Special Report

IPE at 20: Change pension regulation and enhance economic growth

Low growth is a worldwide economic problem. Western economies, in particular, suffer from the effects of secular stagnation, balance-sheet recession and stringent budgetary rules prohibiting extra government spending, write Jean Frijns, Theo van der Klundert and Anton van Nunen

-

Special Report

IPE at 20: Mental models of the future

When IPE was founded in 1997, the mainstream investment approach was based on the Modern Portfolio Theory. The approach allowed users to apply statistical and mathematical protocols to construct portfolios, which was convenient