Sponsored commentary from Thornburg Investment Management

International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP) have given us the tools to compare and evaluate revenue streams from vastly different sectors and industries. For example, we can calculate and contrast a firm that sells agricultural products in Germany vs. a firm that offers cloud computing services in Singapore.

ESG has been subjected to similar expectations even though the definition itself varies considerably from those looking to complement existing financial analysis to those looking to quantify the impact that capital markets have on society. However, the reality is that just as there is art as well as science to creating financial reports, the same occurs in applying ESG standards.

In fact, the many standards don’t pretend to strive for the same thing.

- Some, like the EU Taxonomy for Sustainable Activities are a regulatory standard for understanding the ESG of economic activities in that market – but no comparable initiative exists in most markets.

- Stewardship Codes like those in the UK and Japan articulate important expectations, but don’t show the methods through which those should be met.

- Standards like the Carbon Disclosure Project (CDP), the Task Force for Climate-related Financial Disclosure (TCFD), or the Global Reporting Initiative (GRI) present frameworks under which companies can provide disclosure around their management of particular stakeholder concerns.

- Similarly, the recent merger of the Sustainability Accounting Standards Board (SASB) and International Integrated Reporting Council (IIRC) to form the Value Reporting Foundation comes as investors seek tools to focus on financially material ESG issues.

- Yet others, such as commercial data providers MSCI and Sustainalytics, offer scoring tools and methodologies to evaluate what is good, or bad, risky, an opportunity and /or impactful in ESG.

Recently MSCI’s Chief Executive Officer told The Financial Times that the whole argument surrounding ESG ratings is misplaced. Indeed, Thornburg Investment Management’s (Thornburg) view is that rather than survey every available standard and framework, companies need to conduct materiality analyses appropriate to their own businesses and stakeholders and disclose accordingly. The investment industry in turn needs to identify standards that focus on alignment with academic and industry ESG research, which continues to evolve.

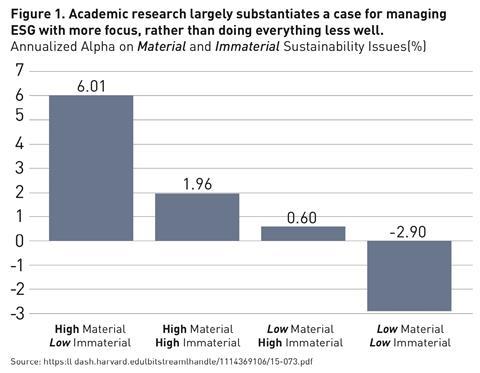

However, before we have a final word on the social impact of a particular investment or its alignment with United Nations Sustainable Development Goals, we must make sure our investment decisions are rooted in the kind of substantiated ESG that has improved performance. The oft-quoted Khan, Serafeim, and Yoon “Corporate Sustainability: First Evidence on Materiality”[1] paper sought to demonstrate the value of ESG in contributing to risk adjusted returns. The approach was rooted in material factors based on the SASB Standards, not abstract values or hard-to-measure social impact. More recently other work[2] [3] has shown promise, and we should test whether these conclusions hold true throughout economic cycles, across investment vehicles, and even for specific securities.

While it may irritate some purists, the relevance of ESG factors for the improved management of financial risk and return should be an easy place to agree to begin. Below is the methodology framework deployed by Thornburg to incorporate ESG analysis on companies that are potential investments. Our process begins with materiality, which depends on reliable data and experienced analysis, and ends with ongoing stewardship.

Figure 2. The Thornburg ESG Analysis Methodology Framework

Step 1: Materiality

- Identify on the factors that influence return and risk

- Establish material ESG factors for each proposed investment

- Analyze company results and prospective strategy

Step 2: Due Diligence & Data

- Research and perform due diligence the relevant ESG factors in the company’s materials

- Compare the quality of disclosure to other indicators of management quality and board oversight

Step 3: Assessment

- Integrate analysis of material ESG factors and third-party ESG ratings within our comprehensive investment research

- Assess business, financial and ESG sustainability to identify opportunities and manage risks

Step 4: Decision

- Establish an appropriate compensation for the determined risk

- Decide to invest or defer, scaling position size and holding period as necessary

Step 5: Stewardship

- Monitor ESG risks and reporting

- Vote company proxy with purpose

- Establish opportunities for company engagement

Summary: It’s a Material World

Asset managers, regulators, NGOs, and other stakeholders should first work to understand, evaluate, and bring to bear financially material ESG factors in making investment decisions. The work certainly can’t end there but if we wait for a singular ‘winner’ of ESG standards that may never come.

As we know, there are still two major global standards for accounting, despite convergence efforts since 2002. The financial services industry, both buy and sell sides, have learned how to interpret and compare reporting under the two systems. There is no reason that the same cannot happen with ESG standards. What may matter more than third party scores, Bloomberg has argued[4], is the investment industry’s need for transparent, high quality ESG corporate data that allows firms such as Thornburg to conduct their own due diligence and assessment.

Jason Brady is President and CEO of Thornburg Investment Management.

Jake Walko is Director of ESG Investing & Global Investment Stewardship at Thornburg Investment Management.

FOOTNOTE

[1] https://dash.harvard.edu/bitstream/handle/1/143https://dash.harvard.edu/bitstream/handle/1/14369106/15-073.pdf69106/15-073.pdf

[2] https://www.stern.nyu.edu/experience-stern/about/departments-centers-initiatives/centers-of-research/center-sustainable-business/research/research-initiatives/esg-and-financial-performance

[3] https://www.mckinsey.com/business-functions/sustainability/our-insights/the-esg-premium-new-perspectives-on-value-and-performance

[4] https://www.bloomberg.com/professional/blog/opening-the-black-box-of-esg-data/

Disclaimer: The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market. This is not a solicitation or offer for any product or service. Nor is it a complete analysis of every material fact concerning any market, industry, or investment. Data has been obtained from sources considered reliable, but Thornburg makes no representations as to the completeness or accuracy of such information and has no obligation to provide updates or changes. Thornburg does not accept any responsibility and cannot be held liable for any person’s use of or reliance on the information and opinions contained herein. Investments carry risks, including possible loss of principal. Outside the United States This is directed to INVESTMENT PROFESSIONALS AND INSTITUTIONAL INVESTORS ONLY and is not intended for use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to the laws or regulations applicable to their place of citizenship, domicile or residence. Thornburg is regulated by the U.S. Securities and Exchange Commission under U.S. laws which may differ materially from laws in other jurisdictions. Any entity or person forwarding this to other parties takes full responsibility for ensuring compliance with applicable securities laws in connection with its distribution. For United Kingdom: This communication is issued by Thornburg Investment Management Ltd. (“TIM Ltd.”) and approved by Robert Quinn Advisory LLP which is authorised and regulated by the UK Financial Conduct Authority (“FCA”). TIM Ltd. is an appointed representative of Robert Quinn Advisory LLP. This communication is exclusively intended for persons who are Professional Clients or Eligible Counterparties for the purposes of the FCA Rules and other persons should not act or rely on it. This communication is not intended for use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please see our glossary for a definition of terms.